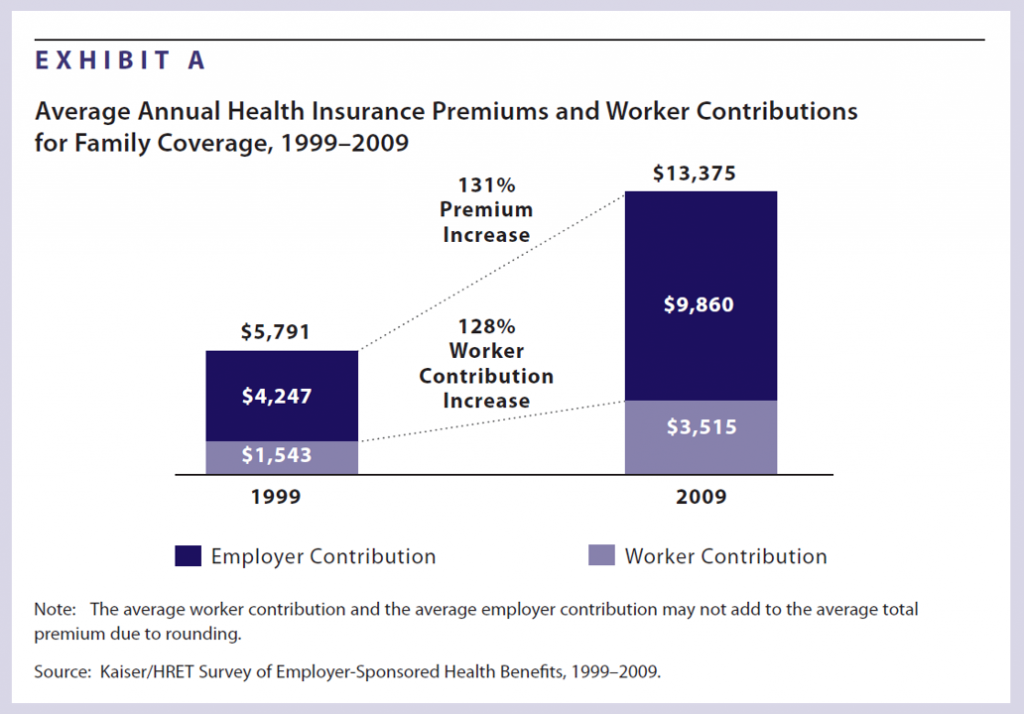

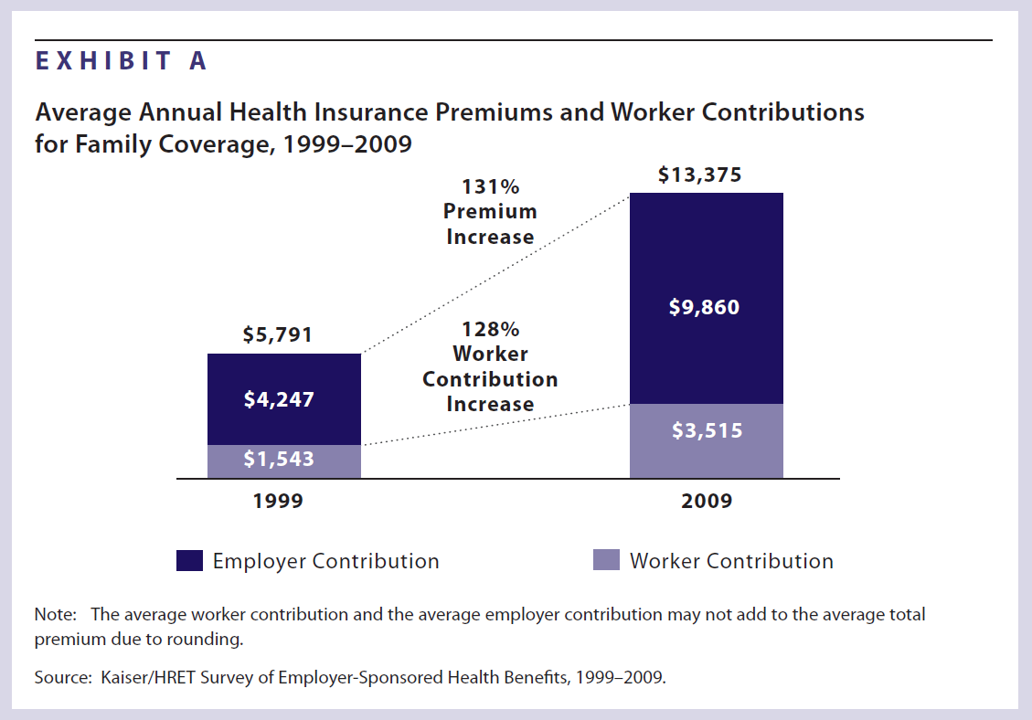

Health insurance premiums for a family increased 131% between 1999 and 2009, according to the latest survey from Kaiser Family Foundation (KFF) and Health Research & Educational Trust’s (HRET’s) Employer Health Benefits 2009 among employers. KFF and HRET have conducted this survey since 1999.

Health insurance premiums for a family increased 131% between 1999 and 2009, according to the latest survey from Kaiser Family Foundation (KFF) and Health Research & Educational Trust’s (HRET’s) Employer Health Benefits 2009 among employers. KFF and HRET have conducted this survey since 1999.

In 2009, in raw number terms, family health insurance costs employers, on average, $13,375. Workers pay $3,515 of this premium, on average about 26% of the total. This approaches nearly $300 out of a monthly paycheck.

Worker contributions substantially vary between small and large employers: the contribution is nearly $1,000 more if you work in a small firm, at $4,204. It’s $3,182 for employees in large firms.

The percentage increase in premium from 2008 was 5%. For context, the average increase in American worker’s wages between 2008 and 2009 was 3%.

Premiums range from a low of $11,083 for high-deductible plans to a high of $13,719 for an HMO, nationally.

Premiums also vary by industry sector: the health segment has the highest premiums, at $14,880,; retail has the lowest premiums at $12,238.

60% of employers offered health insurance to employers, a drop from 63% in 2008. KFF/HRET calculates that this is not a statistically significant decline. Known as the “offer rate,” the survey does not take into account those businesses that failed between 2008 and 2009. The highest offer rate of health insurance among employers was 69% in 2000. The health insurance offer rate is near 100% for large employers, and 59% for small firms.

86% of companies that offer health insurance offer only one type of plan. The larger the firm, the more types of plan are available from which workers can choose.

The proportion of firms offering retiree health benefits declined by 2 percentage points to 29%, from a high of 66% in 1988.

Interviews with 2,045 employers were conducted between January and May 2009.

Health Populi’s Hot Points: In the context of the recession, the statistics in this survey are quite positive. Health premium costs rose ‘only’ 5% versus wage increases of, on average, 3%. And, the percentage of employers offering health benefits to employees fell from 63% to 60% — not a statistically significant decline, the report’s statisticians conclude.

Underneath this fairly happy story is a big fat wild card: what happens in employers’ health plan design in 2010? Employers still in business have survived the recession to-date; how strong are their financials? How willing will they be to sustain another round of 5% or 10% cost increases? According to several benefit consultancies, health costs could increase in double-digits in 2010. How might this translate into employers willingness to offer health insurance?

The conservative guesstimate is that employers who continue to offer health benefits will also continue to drop their level of subsidy for employees, who in 2009 are paying about $300 each month to buy into their health plans — in addition to higher copayments for services and branded prescription drugs.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're