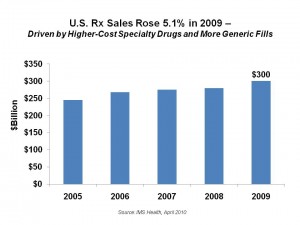

The two ends of the prescription drug cost-continuum drove growth in Rx spending in 2009: expensive specialty drugs and low-cost generics. IMS Health National Sales Perspectives study reports that prescription drug spending rose to $300.3 billion in 2009 in the U.S., a 5.1% increase in 2009.

Generic drugs now make up 75% of prescriptions filled — 3 in 4 prescriptions. This level grew from 57% in 2004 — a 31% growth over the 5 year period.

Specialty drugs, which include injectable biotech meds that deal with cancers and other complex conditions, made up 21% of U.S. pharma sales, nearly triple their component in 2008 at 7.5%. These are among the highest-cost drugs on the market and usually sit in a special tier of pharmaceutical pricing.

IMS found that antipsychotics rank as the top class of medications sold int he U.S., with sales of $14.6 billion. The largest class of Rx drugs sold by prescription volume (not $sales) were cholesterol drugs (lipid regulators) including Lipitor ($7.5 billion), Nexium ($6.3 billion), and Plavix ($5.6 billion) — which were also the top 3 selling individual drugs overall in 2009. The fourth most popular Rx sold by sales was Advair Diskus for asthma, with $4.7 billion in sales.

Another important trend is that anti-depressants rose in the sales table from the fifth-largest Rx class to #4.

Underneath IMS Health’s pretty positive top-line headline is important subtext that tells the story of Rx sales in the recession. This headline is that “Rx Value Sells” based on the fact that both very high-cost and ultra-low-cost drugs drove sales in 2009.

Underneath IMS Health’s pretty positive top-line headline is important subtext that tells the story of Rx sales in the recession. This headline is that “Rx Value Sells” based on the fact that both very high-cost and ultra-low-cost drugs drove sales in 2009.

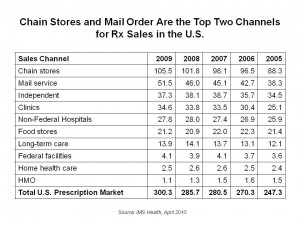

See the table showing sales channels for Rx’s in 2009 to the right. This illustrates that the growth channels for prescription drug sales in the U.S. continue to be chain stores and mail order. In the first order, Walmart and other chains that promoted cheap $4 generics for 30-day supplies and $10 for 3 month supplies attracted people to continue on chronic care meds — that were, of course, generic and not higher-cost brands. Where Big Pharma companies were successful in 2009 was in distributing coupons and other cost-lowering tools to help consumers managing chronic conditions stay on more expensive meds. This created a more compelling value-proposition in the eyes of the health consumers. For now, with 75% of Rx’s dispensed being generics, that’s where American health citizens are finding high value where generics exists in their chronic care categories.

As for higher cost specialty drugs, that category has substantially and quickly grown to 21% of Rx’s in just a few years’ time. Companies involved in this category must continue to innovate for disease states and prove their high-value proposition. Health plans and payers will be seeking that rationale in the emerging world of comparative effectiveness and value-based benefit design.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,