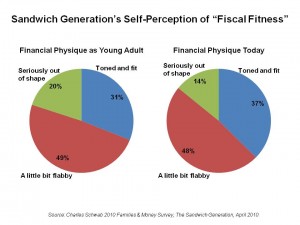

While one-half of the members of the Sandwich Generation of Americans believe their kids will be more successful than they are, more than one-half also feel fiscally unfit — either “a little bit flabby” or “seriously out of shape.”

While one-half of the members of the Sandwich Generation of Americans believe their kids will be more successful than they are, more than one-half also feel fiscally unfit — either “a little bit flabby” or “seriously out of shape.”

These schizophrenic statistics come out of Charles Schwab’s 2010 Families & Money Survey. The poll was conducted among 1,000 Sandwich Generation adults with young adult children ages 23-28 and living parents in February 2010.

Two-thirds of Sandwich Generation (SandGen) parents care more about financial fitness than physical fitness, according to Schwab’s findings. The chart shows that 1 in 2 view their “financial physique” as being flabby in youth, and equally flabby in SandGen’hood.

Contributing to the feeling of ‘fiscal flabbiness’ is the fact that 41% of SandGen parents are still providing some level of financial support to their adult kids. Only one-half of these parents say their kids are fully independent. Most expect their offspring to be financially independent by the time they’re 30 years old.

44% of SandGen parents say that it is a priority for them to help their children financially. At the same time, 64% of SandGen parents claim their kids are not worried about being a financial burden on them. This may then lead to 1 in 5 parents saying that today’s young adults have more of a sense of entitlement about money than previous generations.

56% said saving for retirement was their priority. 85% are in fact at least a little worried about their own personal financial future. The worries include not being able to retire (29%), outliving retirement money (22%), not saving enough (22%), and worrying about their children not becoming financially independent (11%).

The silver lining to the recession, Schwab found, is that half of SandGen folks are learning to live within their means and getting more engaged with their finances, financial statements and contracts. 6 in 10 are being more cautious with credit card use, and 1 in 2 is reading fine print more closely.

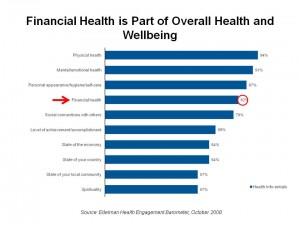

Health Populi’s Hot Points: Wellbeing is built on lots more than just “health care.” In 1946, in the Preamble to the Constitution of the World Health Organization, WHO’s definition of health was written: Health is a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity.

Financial wellbeing, however a person self-defines that state, is an integral part of whole health. When the Charles Schwab survey separates the fiscal from physical fitness, it’s not a fair segmentation. Personal financial stress directly and negatively impacts mental and physical health. My very pragmatic father, another Charles S. and a child of the Depression, was known to quote from Proverbs at particularly curmudgeonly moments, “When there’s no money, love flies out the window.”

While I don’t subscribe to that philosophy (hey, I’m my mother’s romantic daughter and a Jane Austen fan through and through), I am a student of the whole, WHO school of health. Let me remind you, too, of a statistic from the 2008 Edelman Health Engagement Barometer— the chart at the left shows that, after physical health, mental and emotional health, and physical appearance, financial health ranks very highly by most as part of overall health and wellbeing.

It’s never too late to start saving — and Schwab shows that the SandGen demographic dearly wants to do more of that. The more they’ll save, the better they’ll feel. And perhaps their kids will learn the lessons of compound interest over the long term.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a