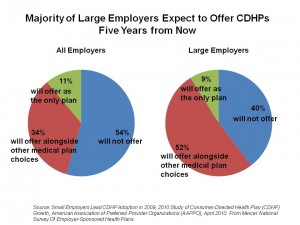

The growth of consumer-directed health plans (CDHPs) continues as employers look for ways to rationalize their health spending in the midst of annual double-digit health cost increases. By 2015, 61% of large employers will off CDHPs. Overall, 45% of employers think they’ll be offering CDHPs in five years.

These data were found through the Mercer National Survey of Employer-Sponsored Health Plans, sponsored by the American Association of Preferred Provider Organizations (AAPPO), published in April 2010.

In 2009, 15% of all employers offered a CDHP: this grew from 10% in 2008. 18% of employers are likely to offer a CDHP this year.

The AAPPO estimates that 18 million people were enrolled in CDHPs in 2009, and increase of over 28% over 2008. It’s the small employers that are driving this trend, as well as employers centered in the Midwest and the South.

Karen Greenrose, RN, AAPPO’s prsident and CEO, said that, “At a time when employers are faced with the difficult choice of limiting benefits or raising health care costs to their employers, they are turning to [CDHPs] given the cost savings inherent in these plans.”

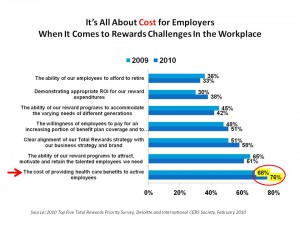

Health Populi’s Hot Points: Employers are “continually looking for ways to reduce benefit costs without reducing benefits,” according to Larry Boress, President and CEO of the Midwest Business Group of Health. It’s all about cost for employers when it comes to how to reward employees, shown in the slide at the right. Here, Deloitte found in its survey published in February that the most important priority among employee benefits professions in 2009, and even more important in 2010, is the cost of providing health benefits to active employees.

What’s concerning in the adoption of CDHPs by employees is that too many don’t know how to use them. Consider this “health plan illiteracy.” For employees and dependents to use CDHPs to their most effective extent, people need to become informed consumers of these plans and understand that spending money earlier can save money in the long run. There’s some evidence that CDHP members may not be filling prescription drugs or postponing them. This could be a short-term fiscal decision that creates longer-term bad outcomes and potentially higher spending for the employee.

That employers want to spend smarter when it comes to health care gets no argument from me. But CDHP enrollees need the tools and information that help them be more informed health consumers so they spend smarter on their personal health, as well.

For more insights into this survey, see my colleague Fran Melmed’s take on her blog at Free-Range Communication.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for