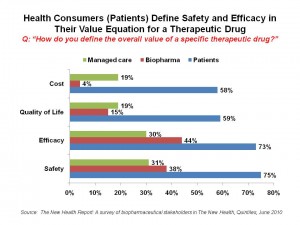

Most health consumers define the value of drugs in terms of safety and efficacy first, then quality of life and cost second. These priorities are similarly shared by both biopharma executives and managed care management.

Where consumers diverge with the two health industry stakeholders, though, is with respect to their power: while about 1 in 3 biopharma and managed care execs believe that patients will be influential in the success or failure of new therapies over the next five years, only 11% of patients say that “people like me” will be influential over what new drugs will be available in the next 5 years. And, 59% believe they won’t be very influential.

This intriguing finding comes from a survey from Quintiles, polling biopharmaceutical stakeholders including 144 biopharmaceutical executives, 129 managed care execs, and 1,048 U.S. adults age 18+, conducted in February-March 2010.

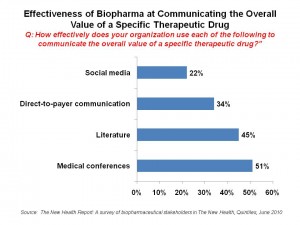

As for biopharma’s competence at communicating “value” directly-to-end users (consumers, patients, caregivers), the industry admits to missing the boat when it comes to engaging with consumers via social media, as shown in the chart. While half of biopharma execs believe they use the Old School methods of medical meetings and “the literature” effectively  to communicate a drug’s value proposition, only 1 in 5 think they’re getting social media right. Direct-to-payer communication is also a weakness, in the eyes of biopharma pholk.

to communicate a drug’s value proposition, only 1 in 5 think they’re getting social media right. Direct-to-payer communication is also a weakness, in the eyes of biopharma pholk.

Health Populi’s Hot Points: Communicating the value of a prescription or specialty drug is a sine qua non for bio/life science companies in this era of (1) consumer-directed health (broadly writ) and (2) comparative effectiveness. Pharma and biotech companies must clearly state the case for at least two key audiences: first, the patient-consumer-caregiver, who must reach into a pocket to invest a significant co-pay or coinsurance; and second, the payor, who rules a therapy on or off of a formulary, and tiers it to ‘nudge’ users toward one vs. another based on efficacy, safety, quality of life factors, and yes, cost — which all add up to “value.”

Bio and life science companies are surely behind in getting up close and personal with patients in social networks. Online social networks are already providing useful channels for engaged patients and health consumers to share their views on these therapies at places like PatientsLikeMe, Organized Wisdom, DiabetesMine, TuDiabetes, WEGOHealth, and other emerging networks bringing consumer-driven transparency to a once opaque pursuit. That is, the search for value in bio/pharmaceuticals. That search continues, and as patients see the light that transparency brings, they’ll figure out the power they have to leverage when it comes to demanding products that work, that are safe, that add life to years. That’s value spelled with a capital “V.”

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a