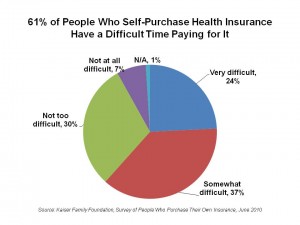

61% of American health citizens have difficulty paying for health insurance when they go out on the open market to purchase it as individual customers.

61% of American health citizens have difficulty paying for health insurance when they go out on the open market to purchase it as individual customers.

A survey from the Kaiser Family Foundation (KFF) finds that most people in the U.S. who go for health insurance on their own have trouble paying for it.

14 million people in the U.S. aren’t covered by employers and seek so-called non-group or individual health insurance policies. Premium increases for these policies averaged 20% in early 2010. Nearly 1/2 of these people are self-employed or work in small business.

The average out-of-pocket health spending for individual health plan consumers with family plans was $5,149 in 2009 before health insuarnce kicked in past the deductible. 26% of individual health plan consumers had deductibles of $5,000 or more, and 6% had a deductible of $10,000 or more.

73% (about 3 in 4 individual haelth plan consumers) are worried their health plans will raise premiums beyond their ability to pay for them.

This survey was conducted among 1,038 U.S. adults age 18-64 who purchase health insurance on their own.

Health Populi’s Hot Points: This survey illustrates the dire need for health insurance changes that the Patient Protection and Affordable Care Act (PPACA, broadly referred to as “health reform”) passed earlier this year seeks to remedy. However, that law doesn’t kick in for individual health consumers without insurance until 2014, and the poll shows that individual health citizens without group insurance are already having trouble paying for their plans. Furthermore, at least 1 in 4 of individual policyholders have very high deductibles of $5K or greater, so the OOP costs for millions of Americans have led to financial distress or at the extreme (which is not uncommon), bankruptcy.

What will PPACA do to solve the health plan-challenged individual consumer? Not enough in the short run to 2014. After that, which is 2 years post-the next President election, the wild cards fly and a straight-line forecast of that future isn’t practical. Scenarios will be the best way to answer the question, “what will the individual insurance market look like in 2014?”

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a