What is a luxury good? A good working definition is a good for which demand increases as income grows. Contrast this to a “necessity good,” something that people need regardless of level of income.

What is a luxury good? A good working definition is a good for which demand increases as income grows. Contrast this to a “necessity good,” something that people need regardless of level of income.

Baby Boomers are morphing their idea of what constitutes a luxury good versus a necessity in light of the recession, according to a new study from New York Life, MainStay Investments Boomer Retirement Lifestyle Study, published August 5, 2010.

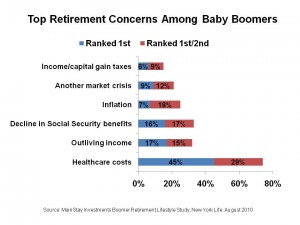

The chart illustrates that 3 in 4 Boomers put health care costs as a top #1 or #2 retirement concern. Furthermore, 98% of Boomers called health care coverage a basic need, not a luxury, in this survey. The second-most important basic need cited by Boomers was an Internet connection, noted by 84% of Boomers, followed by shopping for gifts (birthday/special occasion), among 66% of Boomers. Pet care is also considered a basic need, #4 in line.

3 in 4 Boomers would rather spend less now to invest in a more comfortable retirement, according to the survey. Thus, 40% of Boomers say they’ll delay retirement to be able to afford to live the retirement lifestyle they envision.

Health costs are, therefore, the biggest threat to a comfortable retirement among affluent Boomers.

This poll was conducted among Boomers age 45-65 with over $100,000 in investable assets who are not yet retired; thus, the sample was geared to more affluent Boomers. MainStay/NY Life calls these the “mass affluent.”

Health Populi’s Hot Points: Health costs are the #1 threat to Boomers’ economic security over the long run (that is, in retirement). This is analogous to the fact that Medicare is the #1 driver of the U.S. long-term deficit.

Let’s push the analogy a bit further: what can Boomers do to ameliorate their challenge? MainStay Investments found that Boomers will save more money, adjust their investment allocations, and seek help from financial planning professionals.

What will the U.S. do in kind? To save more, where can Federal spending be cut, and what categories can be reallocated toward health, or to conserve health spending? And who will be the health fiscal planning gurus that the President and Congress turn to for advice on these issues?

With Peter Orszag resigning from the head job at the Office of Management and Budget, along with Christina Roemer’s resignation as chairwoman of the Council of Economic Advisors, there’s a labor shortage of economic gurus advising the President. Who fills these positions will help determine how Boomers, and the rest of Americans, fare health-wise in this continued jobless economic recovery.

Thank you FeedSpot for

Thank you FeedSpot for