Two reports, from Consumers Union and the AARP, put the pharmaceutical industry in the spotlight again this week, and not in a good way.

Two reports, from Consumers Union and the AARP, put the pharmaceutical industry in the spotlight again this week, and not in a good way.

First, Consumer Reports polled U.S. adults who take prescription drugs and found that 39% took some action to reduce costs. 27% didn’t take the Rx as prescribed: 16% didn’t fill the prescription, 12% took a drug past its expiration date, and 4% shared a prescription with someone else. These and other survey findings are discussed in Consumers say big pharma influence on docs is concerning, published in the Consumer Reports Health Blog on August 24, 2010.

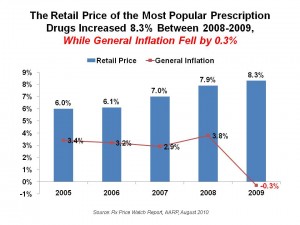

Second, the AARP calculated that the average retail price for brand name prescription drugs used by Medicare enrollees grew much faster than average price inflation between 2008 and 2009 — in fact, inflation fell by 0.3%, while the prices for the most widely used brand name Rx’s grew by 8.3% over the year, according to AARP’s Rx Price Watch Report.

Four widely used brand name drugs had retail price increases over 20% in 2009, including Flomax (for prostate, with an increase of 24.8% between 2008-9), Provigil (for sleep disorders, 22.7%), Alphagan P (for glaucoma, 21.5%), and Prevacid (for ulcers and GERD, 21.3%).

And here’s a number sure to give the Health Populi reader Rx sticker-shock, per the AARP report: “An older American who takes 3 prescription drugs is likely to have experienced an average annual retail cost of therapy of $4,146 in 2009, assuming that the consumer uses brand name drugs for these chronic conditions.” The cost of therapy was found to be 31.7% higher than the average cost in the year prior to implementation of Medicare Part D.

The Consumer Reports survey was conducted in May 2010 by telephone among 1,154 U.S. adults 18 and over who currently take prescription drugs.

Health Populi’s Hot Points: Consumers remain cynical about pharmaceutical companies’ marketing through doctors: Consumer Reports found that 2 in 3 Americans believe that pharmaceutical companies have too much influence over physicians’ prescribing behaviors. The fact that the companies have been raising retail prices on seniors’ heavily-consumed prescription drugs contributes to the continued skepticism about pharmas as health care partners for patients.

In this era of social engagement and transparency in health, pharma companies must recognize that pricing decisions made in one part of the company have direct and specific impacts on other parts of the company — like marketing, and in the CFO’s office, on the bottom-line.

Thank you FeedSpot for

Thank you FeedSpot for