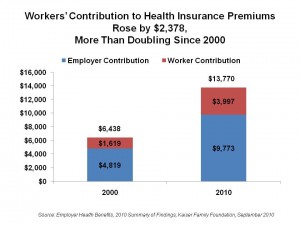

Since 2000, American workers’ contributions to health insurance premiums more than doubled, to nearly $4,000 a year from $1,619 ten years earlier. The total premium going to health insurance per worker for family coverage is $13,770 in 2010, with nearly $10,000 being borne by the employer.

Since 2000, American workers’ contributions to health insurance premiums more than doubled, to nearly $4,000 a year from $1,619 ten years earlier. The total premium going to health insurance per worker for family coverage is $13,770 in 2010, with nearly $10,000 being borne by the employer.

Workers’ share of premium increased 147%, and employers’ grew 114%.

The Kaiser Family Foundation/Health Research & Educational Trust’s (KFF/HRET) annual 2010 Employer Health Benefits survey tells the story of health insurance costs that continue to grow, the rates of which depend on the type of health insurance purchased. For example, workers in high-deductible health plans saw their cost of coverage increase between 8-13% between 2009-10.

Another growth trend that will continue is employers’ levying greater cost-sharing for health onto employees. KFF notes that, in a tight labor market in a recession, employees can’t simply vote with their feet by seeking employment, and better benefits, elsewhere. This year, 38% of large firms (with over 200 employees) reduced the scope of benefits or increased cost-sharing. 36% of large employers increased workers’ share of premium, up from 22% in 2009.

KFF conducted this survey by telephone among 2,046 public and private employers with 3 or more workers. Polling was conducted between January and May 2010 among firms providing health insurance as a benefit to any employees.

Health Populi’s Hot Points: The cost of health premiums vary throughout the U.S. and by type of firm: 20% of covered workers are in plans with annual total premiums for family cover of over $16,524. On average, covered workers pay 30% of the family premium, up from 27% in 2009. On average, workers paid $3,997 for family coverage, up from $3,515 in 2009.

In Health Populi on August 19, 2010, we discussed the expected 9% increase in health costs expected by the National Business Group on Health in 2011. It is also expected that even more costs will be borne by employees. In a stagnant job and salary market, how will employees living paycheck to paycheck fare in this scenario? Some will forego necessary care, postponing meeting the high-deductibles they have signed on for.

Deloitte’s recent survey of 4,000 U.S. consumers in January-February 2010 found that 1 in 5 Americans postponed health care, and 40% did so because of cost.

There’s an even more dramatic statistic in the KFF survey from March 2010 which found that over 1 in 2 American adults has self-rationed health care in the past year. Adjust your plans according, those who market goods and services in health: people aren’t always Rational Economic Men and Women when it comes to spending on health.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for