The U.S. has among the lowest tax-to-GDP ratios in the developed world, including state and local taxes. Only Mexico, Turkey and Korea have lower tax-to-GDP ratios among OECD members, at somewhere between 20 and 28%. The Organization for Economic Cooperation and Development (OECD) believes that U.S. tax rates are, in fact, too low and, even with modest tweaks upward, “would still keep the overall tax burden at a relatively moderate level and not impose excessive costs,” OECD states in its Economic Survey of the U.S., released today.

The U.S. has among the lowest tax-to-GDP ratios in the developed world, including state and local taxes. Only Mexico, Turkey and Korea have lower tax-to-GDP ratios among OECD members, at somewhere between 20 and 28%. The Organization for Economic Cooperation and Development (OECD) believes that U.S. tax rates are, in fact, too low and, even with modest tweaks upward, “would still keep the overall tax burden at a relatively moderate level and not impose excessive costs,” OECD states in its Economic Survey of the U.S., released today.

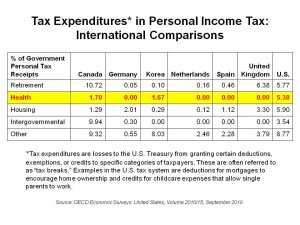

“Tax breaks have grown significantly since the major tax reform of 1986,” the report notes, and are more generous in the U.S. than in other countries, as shown in the chart. The OECD argues for such tax breaks, from home mortgage interest deductions to the payroll tax of employer-provided health insurance coverage, should be reduced, or even eliminated.

Regarding employer-sponsored health insurance premiums and taxable income, the OECD believes these encourage over-use of health care resources. Noting that the Accountable Care Act (i.e., health reform) reduces this ‘break’ by putting an excise tax on so-called “Cadillac” plans, the OECD thinks, still, that the Cadillac plan tax won’t stem excess cost growth in the U.S. health sector.

The report goes on to discuss the long-term fiscal outlook in America, calling it, in a word, “challenging.” OECD points out the most challenging aspect of this will be demographic pressures of the aging of Baby Boomers and the stress they’ll put on an ever-deteriorating national budget particularly due to pension (read: Social Security) and most especially Medicare benefits. At the same time, the population of workers contributing to Social Security and Medicare taxes will grow much more slowly, stressing the funding of these entitlement programs.

Health Populi’s Hot Points: One gets the feeling the OECD’s report is saying, “Take that, Tea Party!”

“The major long-term risk to fiscal sustainability…is public health care outlays,” OECD writes on page 29 of the report. Spending on Medicare and Medicaid will increase from 5% of the GDP in 2009 to 11% by 2035. OECD says that if Congress “maintains” the provisions in the bill as passed into the ACA law, the long-term budget scenario will be improved,

OECD is bullish on the prospects for the CMI — the Center for Medicare and Medicaid Innovation that will pilot new payment reforms and models that migrate the U.S. away from fee-for-service — which drives volume-based payments and excess cost growth. Furthermore, OECD recommends that the government encourage dissemination of information on the cost-effectiveness of treatments and procedures to payers — which includes both institutional payers (like employers and government purchasers) and individual consumers, alike.

While most pundits talk about U.S. health reform as a strictly domestic issue, it’s important to consider the process in a more global context. Health care costs have been a drain on corporate profits and companies’ competitiveness on the global stage; GM’s financial woes are largely due to its legacy of retirees consuming huge amounts of health resources, along with growing costs among active employees. As good corporate practice looks to benchmarking to compare best-practices in business processes, it’s instructive to look at a benchmark such as the tax expenditures noted above, contrasted to the rest of the developed world, to get a sense of where the U.S. system (health and home sectors, especially) sits vis-à-vis other nations.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a