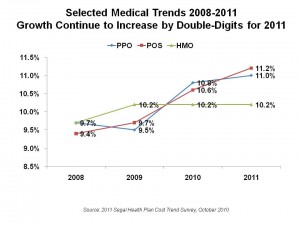

Medical costs will grow between 10% and 11% in 2011, depending on whether an enrollee is opting for a PPO (11%), a POS (11.2%) or an HMO plan (10.2%). These growth rates are similar to 2010 increases, with the largest percentage growth projected for point-of-service plans from 10.6% in 2010 to 11.2% next year. These cost increases are roughly eight-times inflation in the consumer price index (CPI), gauged at 1.2% in July 2010 for urban consumers.

Medical costs will grow between 10% and 11% in 2011, depending on whether an enrollee is opting for a PPO (11%), a POS (11.2%) or an HMO plan (10.2%). These growth rates are similar to 2010 increases, with the largest percentage growth projected for point-of-service plans from 10.6% in 2010 to 11.2% next year. These cost increases are roughly eight-times inflation in the consumer price index (CPI), gauged at 1.2% in July 2010 for urban consumers.

The 2011 Segal Health Plan Cost Trend Survey reflects additional costs the benefits consultants that plan sponsors will incur to comply with the Affordable Care Act (ACA).

The largest single component of cost trend growth is in inpatient hospital admissions: price inflation for the hospital component will grow by 8.5%, and increase in utilization is expected to grow by 2.8%, for a total inpatient cost trend of 12.0% compared to 11.5% in 2010. Physician cost growth is forecasted at 8.2% in 2011, and prescription drugs, 9.2%.

Although a small percentage of total health costs, specialty/biotech cost trend is forecasted to be 17.4% in 2011, a 0.4% point decrease over 2010. This is still nearly double the aggregate prescription drug trend at 9.2%.

Health Populi’s Hot Points: Optimists may point out that medical cost increases have ‘leveled’ to about the same percentage as in 2010. However, the numbers are still double-digits, and they impact/increase very high bases given the double-digit (or near) increases over the past several years. Health care far outpaces general prices in this period. With workers seeing relatively flat salaries over the past five years, health care costs eat up increasing chunks of our paychecks in the U.S.

Employers and plan sponsors will continue to implement cost-management strategies to do two things: to improve enrollee/worker health while stemming cost increases. Segal mentions wellness, care management, value-based designs, data mining, and heavily discounting provider networks (that is, cutting costs on doctors and hospitals who agree to see volumes of patients).

An important question is what impact the ACA’s new prevention, quality, and payment reform initiatives will have on plan sponsors’ costs. Furthermore, as a growing proportion of physicians adopt EHRs under the HITECH Act stimulus, they will be able to better manage patient care at the point-of-care — another opportunity for cost-reduction.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're