Prescription drug formularies are getting more complex to drive cost-savings as well as promote adherence to drug regimens, as told by the data in the 2010-2011 Prescription Drug Benefit Cost and Plan Design Report, sponsored by Takeda Pharmaceuticals NA. The average rate of drug cost increases is 6.3%, compared to 4.4% in the 2009-2010 survey — the lowest rate of increase since this survey was launched.

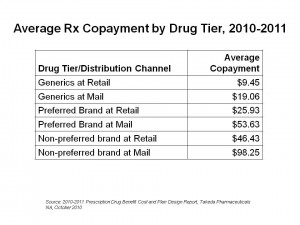

A key part of the story of the new value-based benefit design is told by the co-payment differentials for Rx drugs, shown in the chart. Health consumers who have three-tiered prescription drug insurance face an average co-pay of $9.45 for generics via the retail channel; the generic co-pay is twice that amount via mail. For preferred brands (those that the plans’ formulary favors above other brands in the same therapeutic category), the average copay at retail is $25.93, and more than double at mail. Finally, for non-preferred brands — the place a branded drug does not want to be — the copayment in retail pharmacy is $46.43, and nearly $100 for the non-preferred brand via mail.

As is evident by just this co-payment discussion, formularies have gotten even more complex in 2010-11. Some of the complexities are express in several ways:

- Falling generic co-pays to drive cost-saving, with

- Rising co-pays for both so-called ‘preferred’ as well as non-preferred branded Rx drugs

- Greater use of utilization management tools, such as refill-too-soon, quantity limits, and prior authorization (the top 3 tools used in 2010-11)

- Greater attention to detail when it comes to including — and excluding — specific brand-name drugs as they go off-patent and as ‘switch’ to over-the-counter brands grows.

Employers and benefit sponsors are also undertaking a variety of utilization management tools to stem what they consider inappropriate use of prescription drugs. The most prevalent UM tools include limiting drugs “refilled too soon” (89%), limiting quantities of drugs filled (87%), implementing prior authorization (77%), disease management (68%), step therapy (57%), and outbound telephone calls for reminders (50%). These tactics vary by health condition: for example, in asthma and diabetes, disease management is the #1 used strategy for UM and cost-containment; for depression, it’s limiting the refill too soon.

Takeda conducted this survey among U.S. employers in March-May 2010.

Health Populi’s Hot Points: While the market is driving increasing complexity in value-based prescription drug benefit design, there’s another force that will further shape prescription drug utilization and spending: health reform and the implementation of the Rx provisions in the Accountable Care Act. This will first impact Medicare, the granddaddy of Rx drug payors, as the ACA seeks to close up the doughnut hole. At the same time, though, another factor of health reform — adoption of electronic health records through the HITECH act stimulus funding — will also impact the pharmaceutical industry, perhaps in a more subtle way. But it will hit the industry hard.

Once health providers implement EHRs, they can marry claims data from pharmacy prescriptions filled to outcomes data — such as hospital re-admissions, blood glucose uncontrolled, hypertension spiraling, or cancers treated with a particular drug having sub-optimal impacts. This post-marketing data, gathered in real patients in real time, will help payors and formulary committees better understand what works in what patient populations…and what doesn’t work very well. That’s when formulary design gets really artful — in matching the right drug to the right patient at the right time. This is personalized medicine built on data and evidence. It’s not a pipedream; it’s realizable through data liquidity borne out of EHR implementation.

Postscript – The Wall Street Journal reports today that EHRs will also be useful for adverse-event reporting – which will further impact the pharmaceutical industry – story reported online here.

Thank you FeedSpot for

Thank you FeedSpot for