In the wake of last week’s mHealth Summit in Washington, DC, there’s yet another bullish forecast on mobile health to consider. The Promise of Mobile Health asks the tagline question: “Bigger than DTC?” Euro RSCG’s Life 4D group, published the paper in November 2010. Survey data in the report followed up its October 2009 digital health survey in September 2010 among 502 American adults.

In the wake of last week’s mHealth Summit in Washington, DC, there’s yet another bullish forecast on mobile health to consider. The Promise of Mobile Health asks the tagline question: “Bigger than DTC?” Euro RSCG’s Life 4D group, published the paper in November 2010. Survey data in the report followed up its October 2009 digital health survey in September 2010 among 502 American adults.

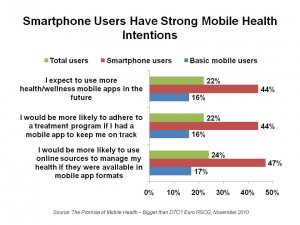

Euro RSCG rightly points out that consumers’ health needs are 24×7: “they take their healthcare needs with them.” The firm believes that the biggest barrier to wider consumer adoption of mobile health is the low penetration of “suitable mobile devices among consumers.” The report’s survey finds that consumers with smartphones are far more active and proactive in health than people with plain old cell phones. The red bars in the chart illustrate smartphone users’ future intentions to engage in mobile health.

The paper’s bullish forecast is that, “Now, the conditions in healthcare are ripe for breakthroughs in mobile technology and applications. The professionals in the domain are the ‘low-hanging fruit’ in the healthcare ecosystem. The next stages of development in mobile healthcare will be shaped by technologies that serve the needs of patients in healthcare.”

Health Populi’s Hot Points: Not so fast, Euro RSCG! When I wrote the paper How Smartphones Are Changing Healthcare For Consumers and Providers in April 2010 on behalf of the California HealthCare Foundation, I asserted that, “The first generation of smartphone apps has yielded value for consumers and clinicians who have adopted them because they are agile, easy-to-use, hand-held, and mobile. These features have not been the traditional hallmarks of health IT. They empower providers and patients on the go. The relatively speedy disruption that apps have had on health providers and consumers is just the beginning of a ‘small is beautiful’ phase of health care information technology and delivery.”

Providers may seem like “low-hanging fruit,” but it’s all about (1) reimbursement and (2) workflow/productivity for them. While ePocrates offers some terrific prescription drug reference apps via mobile, lite ICU monitoring apps provide the emergency physician on-to-go useful alerts, and EMR and operational apps, these individual programs don’t yet knit nicely together. Furthermore, without an EHR in which to store the data generated by apps, the apps sit largely on their own as useful tools for tasks — without the ‘home plate’ infrastructure of the EHR.

For patients, available apps thus far have largely been wellness oriented. The big return for health care costs happens when apps empower activated patients who want to manage conditions — particularly among those people diagnosed with multiple chronic conditions and those with complex therapeutic regimens.

The mother-of-all-barriers to mobile app adoption isn’t the lack of smartphones. It’s patient activation and peoples’ lack of interest in health engagement. Smartphone technology adoption is the easier challenge to overcome; 1 in 2 Americans will have a smartphone by Christmas 2011. Health dis-empowerment and many health citizens’ disconnect with their personal health status are together the Big Barrier standing in the way of the Holy Grail of mobile health.

For physicians, it’s about aligning incentives: what value do mobile health applications afford the practicing doctor who’s managing a business, an ever-demanding patient base, and dwindling reimbursement per patient visit? Those incentives could get more mhealth-friendly once pay-for-performance and patient-centered medical homes become mainstream funding mechanisms for patient care. But a new report from my alma mater the University of Michigan finds the primary care workforce shortage to be a limiting factor in the ability for health citizens to find patient-centered medical homes.

There is certainly a role for mobile health to play in extending the physician workforce — but physicians are trained to follow the evidence. Instead of being “low-hanging fruit,” it might be better to think of providers’ interests in mobile health as being in the process of “ripening”…as evidence proves mhealth’s value.

And what of the “Bigger than DTC?” question? Direct-to-consumer (DTC) promotion is morphing into something beyond expensive ads mass-broadcast during TV news breaks. DTC will become more up-close-and-personal in an opt-in mode, and mobile can certainly be a platform for this new-and-improved DTC for pharma, device, health plans, disease management, and other companies seeking to enforce good behaviors in health citizens who want to closely engage in their health. Euro RSCG correctly recommends that these stakeholders engage in mobile health strategies, understanding the regulatory barriers which are real to these industries. But in the engaged individual’s personal health ecosystem, mobile is the platform that will help her manage health 24×7 (when she wishes to do so). She’ll want to partner with stakeholders who can help her manage her health the ways she wants to — via participatory health with trusted providers.

For the time being, there’s much that can be done with simple cell phones and Texting 4 Health (with props to B. J. Fogg and Richard Adler). There will be early adopters of smartphones and health apps, among both physicians/providers and health citizen-consumers. These will be the pioneers who will make the case and build the evidence for more broad adoption of mHealth.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a