About one-half of physician practices used an electronic health record (EHR) as of late 2010, with 36% of groups still storing health records in paper charts.

About one-half of physician practices used an electronic health record (EHR) as of late 2010, with 36% of groups still storing health records in paper charts.

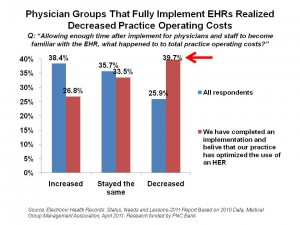

While 1 in 2 physician groups in the U.S. have implemented electronic health records, they confess that they haven’t yet optimized their use. Only 16% of medical groups have implemented EHRs and believe their practices have optimized their EHRs. But optimization has its rewards: over 1 in 3 groups that have had sufficient time to fully implement their EHRs report decreased practice operating costs. Furthermore, 41% of these fully-operational EHR environments have seen physician productivity increase.

With the subtitle, “snapshot of an infrastructure under construction,” a survey from the Medical Group Management Association (MGMA), Electronic Health Records: Status, Needs and Lessons, illustrates the variable EHR journey that U.S. physicians are on to meet HITECH meaningful use objectives. Successfully meeting those objectives over four years will mean $44,000 in the fiscal coffers for each physician in a practice treating Medicare patients (and nearly $65K for doctors treating Medicaid patients). Meeting meaningful use crieria would go a long way toward the ‘optimization’ to which MGMA is referring.

MGMA’s members are administrators and leaders of physicians’ medical group practices. MGMA surveyed 4,588 health organizations’ views about barriers to EHR adoption and their experiences using EHRs in October-November 2010. Together, this poll represents more than 120,000 physicians in practice in the U.S. (roughly, one-fifth of practicing physicians).

MGMA found that ownership type of the physician practice makes a difference in whether the group will try for the HITECH incentives. Independent practices are ahead of medical groups owned by hospitals and integrated delivery systems in terms of adopting and optimizing EHRs. While 1 in 5 independent practices said they’re optimizing their systems, only 9% of provider-owned practices had optimized their EHR.

The reason for this possible counter-intuitive finding is that provider-owned medical practices could be involved in more complex integration challenges than independent practices. Hospitals and IDSs have many more departments and specialties involved — in a potential “too many cooks” scenario slowing down adoption and optimization.

For all medical groups, the issue of training is a major concern. Over one-half of physician groups feel they’re under-allocating resources for the training time needed to make EHRs fully-functioning. There’s a real workflow challenge in implementing an EHR; one respondent commented, “It’s difficult to train personnel and still keep our clinic open and running,” and another, “Patient demand doesn’t drop because schedules are reduced.”

Health Populi’s Hot Points: Interestingly, MGMA’s research was funded by PNC Bank — not an IT vendor. That makes sense as the most commonly cited barrier to physicians not purchasing an EHR is financial. The primary means of paying for EHRs found in the survey is from the business’s cash reserves, noted by 32% of practices, followed by business or personal loans (29%) and subsidization by hospitals and IDSs (22%). Cash reserves and personal loans are most used by smaller practices of 3 or fewer doctors, as well as independent medical practices. Insufficient capital resources and expected loss of productivity during and after the transition to the EHR system are the two most frequently cited barriers to EHR implementation among paper chart users.

Another intriguing finding in this survey is that independent physician groups who aren’t owned by a provider organization can more quickly get to full EHR implementation compared to their provider-owned peers. While provider-owned practices tend to take financial subsidies from hospitals and IDS systems to help pay for EHR investments, independent practices are borrowing money from banks (like PNC) to cover EHR costs. Perhaps there’s something in signing your own name on a dotted line and being on the hook for that repayment that concentrates the mind on fully realizing an ROI. That’s a hypothesis yet to be tested.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're