Two publications this week reinforce the new reality of health and financial insecurity: The Vanishing Middle America issue of Advertising Age (October 17, 2011 issue) and the Sun Life Financial U.S. Unretirement Index – Fall 2011 with the subtitle, “Americans’ trust in retirement reaches a tipping point.”

Two publications this week reinforce the new reality of health and financial insecurity: The Vanishing Middle America issue of Advertising Age (October 17, 2011 issue) and the Sun Life Financial U.S. Unretirement Index – Fall 2011 with the subtitle, “Americans’ trust in retirement reaches a tipping point.”

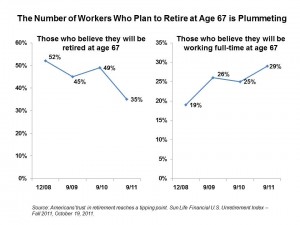

The chart shows the retirement coin’s two sides: since 2008, the proportion of people in the U.S. who expect to retire by 67 dropped from 52% down to 35%; and, those who believe they will be working full-time (I emphasize “full,” not “part,” time) grew from 19% to 29%. 61% of working Americans plan to delay retirement at least three years due to economic factors.

This signals a decline in peoples’ confidence in their financial security in retirement along with their medical security and access to health care services they will need as they age. Confidence in Medicare benefits fell from 20% in 2008 to 8% in 2011 in Sun Life’s survey.

The Unretirement Index was launched in 2008 to measure how changes in the economy, finance, society and public policy impact employed Americans’ confidence in their ability to retire. The Index is based on five factors surveyed across U.S. workers between 18 and 66 years of age: the economy, personal finances, personal health, government benefits, and employee benefits. An Index score of 100 means that the individual has the highest confidence in their retirement future; 0 is the lowest confidence level.

In 2011, the Unretirement Index fell to the lowest level since the survey’s inception in 2008, when the Index measured 46: in 2011, the Unretirement Index fell to 36. Sun Life calculates that in the Recession Period of December 2007 to June 2009, household income fell by 3.2%. Between June 2009 and June 2009, household income fell a further 6.7% in this “unrecovery” period.

It is no surprise, then, that most Americans (87%) believe they will need at least three years to rebuild the savings lost since the start of the recession in 2008.

For the survey, Sun Life polled 1,499 U.S. adults in Knowledge Networks’ KnowledgePanel, a statistically representative sample of U.S. adults, in September 2011.

Health Populi’s Hot Points: A complementary story to Sun Life’s Unretirement Index comes out of this week’s Advertising Age, which focuses on the shrinking middle class in America. Also shrinking is the consumer goods package, where CPG companies are trying to reach lower-income consumers who have only $40 to $50 a week in disposable income left to spend on a family of four for groceries.”Marketers are offering less for less,” E.J. Schultz writes, shrinking package sizes and lowering prices for “penny-pinching consumers.” For example, Coca-Cola has launched 12.5 ounce bottles for 89 cents, and P&G’s Tide is now available in 75 oz. containers for under $10 at Walmart compared with a 100 oz. version available elsewhere for $12.

At the other end of the spectrum, some marketers are focusing on affluent American households — but there are 5% fewer of these than before the recession kicked in.

36% of Americans told Sun Life they delayed a routine or elective medical procedure as part of reducing household spending, up from 20% in September 2009.

Can we shrink-wrap health care, priced for value and households who are earning less today than they did 5 years ago — which is the fiscal reality faced by most U.S. householders?

That’s most of us in the U.S. Expect health rationing and postponement to be the new-normal in health as households tightly manage what’s left in their paycheck after paying for food, rising health premiums and out-of-pocket costs, housing, and energy.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're