The Great American Recession of 2008 will reawaken in 2012, Goldman Sachs expects. In the current economic climate of a jobless recovery and dropping home values, the definition of The American Dream has changed. It’s more about personal fulfillment than financial gain, according to the 2011 MetLife Study of The American Dream: The Do-It-Yourself Dream.

The Great American Recession of 2008 will reawaken in 2012, Goldman Sachs expects. In the current economic climate of a jobless recovery and dropping home values, the definition of The American Dream has changed. It’s more about personal fulfillment than financial gain, according to the 2011 MetLife Study of The American Dream: The Do-It-Yourself Dream.

This is the rise of the “do-it-yourself” American Dream, MetLife found in its survey of 2,420 online adults conducted in September-October 2011. Across the generations — from Silent (born between 1920 and 1945) to Gen Y (born between 1978 and 1993), this redefining concept is relatively consistent.

What’s valued are relationships with friends and family, and a roof over one’s head and the heads of those we love. It’s a chicken in every pot, and that pot doesn’t need to be a $480 Ruffoni Opus braising pan. A private-label pan for $70 works just fine for the new consumer.

While Americans are working longer and harder for each dollar earned, they’re looking to build a level of financial security that’s more of a safety net and less of a McMansion-sized goal. Younger people in Gen X and Gen Y look to be more entrepreneurial, seeking to start their own businesses in this DIY-dream era. For them, it’s not about exceeding their parents’ standard of living.

Underlying this trend across all generations polled is the fact that neither employers nor government institutions are viewed as being “there” for retirement: people in their personal post-recession household economies recognize that they need to rely more on themselves, MetLife discovered. 67% of people say “I can’t rely on the government for my financial security, which means more pressure on me to provide for my family and myself.”

While achieving the American Dream remains important to 82% of Americans overall, it’s important to 89% of Gen Y and 86% of Gen X — thus, younger people more highly index for American Dream achievement, compared with only 50% of the Silent Generation — oldest consumers — who seemed to let go of that Dream, according to the survey.

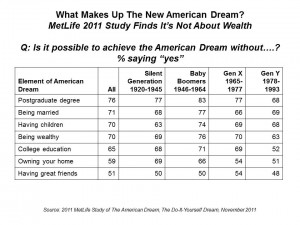

The traditional trappings of the American Dream — a postgraduate degree, being married, having kids, and being wealthy — aren’t essential to achieving the American Dream, all people say from oldest to youngest adult. However, the two areas seen as more relevant are “having great friends,” “owning your home,” and having a college education, especially important for Gen X and Gen Y consumers.

This is the decline of materialism and the era of “enough.” Most consumers in October 2011 say, “I already have what I need; the necessities in my life will always remain constant,” growing from 65% agreeing with that statement in January 2008 to 74% agreeing in October 2011.

Health Populi’s Hot Points: Health is a greater element of the DIY American Dream for older adults – the Silent Generation and Boomers — than for younger people. 41% of Silents say that health is more important than money, friends or a roof over their head; 32% of Boomers say this.

When asked what issues are standing in the way of your achieving an adequate financial safety net, the #1 issue is “living paycheck to paycheck” — which 53% of U.S. adults say they are now doing. 21% say paying for health insurance gets in the way of achieving that personal safety net — with 27% of Boomers (the high across age cohorts) saying accessing health insurance is a safety-net challenge. Gen Y is least worried about paying for health insurance, with only 10% concerned about that issue getting in their American Dream’s way.

The MetLife survey emphasizes a theme Health Populi is tracking in the post-recession: the new DIY Life, which has morphed into DIY Health.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a