Even though Inside-the-Beltway economists have said The Great Recession of 2007 is officially over, it doesn’t look that way when you ask consumers about health spending in 2012, based on results from a survey conducted on behalf of the American Osteopathic Association (AOA). One in 5 U.S. adults is trying to lower their personal health spending. One in four is seeking free or alternate sources of health care.

Even though Inside-the-Beltway economists have said The Great Recession of 2007 is officially over, it doesn’t look that way when you ask consumers about health spending in 2012, based on results from a survey conducted on behalf of the American Osteopathic Association (AOA). One in 5 U.S. adults is trying to lower their personal health spending. One in four is seeking free or alternate sources of health care.

Overall, 1 in 5 people says their health has been negatively impacted by the economy. The AOA discovered that people in the U.S. whose health has been negatively impacted by the economic downturn were twice as likely as people whose health wasn’t affected to have skipped or reduced visits to primary care doctors and health providers to save money. This can lead to short-term fiscal discipline in avoiding early diagnosis and treatment which in the longer run can actually lead to higher costs.

Furthermore, over 1 in 2 Americans look at their household budget before they make health-related decisions. This is especially true for people who lack health insurance, 7 in 10 of whom consider budgets before deciding about health care.

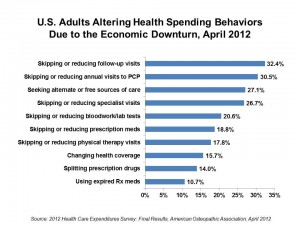

Specific areas where people are denying themselves care to save money are:

- 31% of U.S. adults skipping or reducing annual visits to PCPs and health providers. Nearly double the number of people whose health has been negatively impacted by the economy skip visits.

- 32% of people are skipping follow-up visits to PCPs and providers to save money. Again, double the percent of people whose health was negatively affected by the economy skips follow-ups.

- 27% of people skip specialist visits.

- 21% of people skip lab tests to save money.

- 19% of people skip or reduce prescription drug fills to save money – 43% of those whose health has been negatively impacted by the economy skip pill fills.

- While 11% of people use expired medications to save money, 34% of people whose health was negatively affected by the economy do so.

- 27% of people are seeking alternate or free sources of care — including 25% of people with household incomes of $75,000 or more.

The AOA surveyed 1,069 U.S. adults in March-April 2012 to assess peoples’ views on health care, the economy, and spending.

Health Populi’s Hot Points: The survey instrument smartly analyzed various forms of spending, from general “shopping” to paying for groceries, entertainment, travel, house payments, car payments, and education. All of these areas have taken personal spending hits by consumers, with health care roughly on par with house payments and rent — lower down the spending cut line items than shopping, entertainment, groceries and travel. In aligning health care with other spending priorities, AOA recognizes, correctly, that Americans are becoming health consumers, considering spending on health as competing with other aspects of household spending.

AOA’s findings are consistent with those gleaned by the Kaiser Family Foundation Health Tracking Polls, which for many years has gauged U.S. health consumers’ spending behaviors on health care in the economic downturn. In February 2009, the Poll found that 53% of U.S. adults did something to self-ration health care due to cost:

- 35% of people relied on home remedies or over-the-counter drugs instead of going to see a doctor;

- 34% of people skipped dental care or checkups;

- 27% postponed getting health care they felt they needed;

- 23% skipped a recommended medical test or treatment; and,

- 21% did not fill a prescription for a medicine.

Americans have abhorred the idea of rationing health care, decrying single payor health systems that appear to explicitly ration. However, rationing is already a reality in the U.S. health system, which happens in a variety of ways under other names.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.