Two reports this week suggest countervailing trends for employer-sponsored health benefits: the erosion of the health benefit among companies, and opportunities for those progressive employers who choose to stay in the health benefit game.

suggest countervailing trends for employer-sponsored health benefits: the erosion of the health benefit among companies, and opportunities for those progressive employers who choose to stay in the health benefit game.

In 2010, nearly 50% of workers under 65 years of age worked for firms that did not offer health benefits. The uber-trend, first, is that the percentage of workers covered by employer-sponsored health insurance has declined since 2002. Workers offered the option of buying into a health benefit, as well as the percent covered by a health plan, have both fallen, according to the Employee Benefits Research Institute (EBRI), an organization that has long-tracked this trend. EBRI’s report on Employment-Based Health Benefits: Trends in Access and Coverage, 1997-2010, provides the details behind this declining picture.

Cost is a big determinant of why workers who are offered the health insurance option, don’t join the plan: the percentage of workers who declined coverage due to cost grew from 23.2% to 29.1% between 1997 and 2010.

Coupled with the EBRI report this week is MetLife’s 10th Annual Study of Employee Benefits Trends, which paints a hopeful picture for those so-called “progressive” employers who see opportunity in the fact that health care costs have “exploded” since MetLife launched its study a decade ago. The insurer has found that there is a cadre of innovative firms re-imagining total benefits to drive productivity, wellness, and worker engagement.They’re also re-defining “wellness” beyond physical health, understanding that employee stress caused by financial pressures can compromise productivity and total health, too. Thus, 3 in 4 employers recognize a responsibility to help employees achieve financial security.

But in the recession, employees are less loyal, looking to leave, and are a long way from feeling financially secure. The more progressive employers aren’t blind to this reality – the chasm of trust between employee and employer. This is one of the opportunities MetLife points out in the “shifting sands” of the economy: employees are counting on more help, and for the most part, employers are willing to fill that helpful role role. There is a loyalty gap that needs to be filled, MetLife finds, which has widened since 2008 when 40% of employees believed their employer had a sense of loyalty to them, but in 2011, only 32% felt that way.

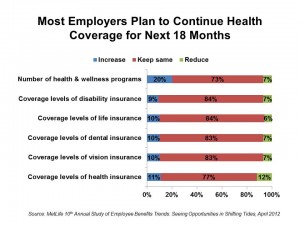

Across all company sizes, 40% expect to maintain current benefits, with 30% doing so by cost-shifting to employees. Only 10% of firms expect to reduce benefits. The good news is that MetLife found that employees expect bigger cuts than employers plan to make.

Health Populi’s Hot Points: MetLife identifies a segment of employers as “progressive,” those who are embracing change in the economy and in consumers as an opportunity to re-engineer benefits towards whole health – physical, mental and financial. What of the other companies who are less progressive, whom MetLife terms the “standards?” They’re not embracing wellness and personal fiscal health in the same way. In so doing, they risk a growing gap in loyalty between worker in company, and losing the most talented workers to other firms who are more enlightened. Those who stay on-the-job could be those less motivated, less engaged, and less productive. This can lead to an un-virtuous cycle, translating into less than optimal results for companies.

Still, it is exciting to witness more companies embracing a new wellness regime to improve employee health, and expanding the definition of “health” beyond the physical. Together, the EBRI and MetLife reports point out we’re at a fork in the road of health benefits. The most enlightened companies are embracing whole health in the total benefit package.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a