Skype and videoconferencing have surpassed the tipping point of consumer adoption. Grandparents Skype with grandchildren living far, far away. Soldiers converse daily with families from Afghanistan and Iraq war theatres. Workers streamline telecommuting by videoconferencing with colleagues in geographically distributed offices.

Skype and videoconferencing have surpassed the tipping point of consumer adoption. Grandparents Skype with grandchildren living far, far away. Soldiers converse daily with families from Afghanistan and Iraq war theatres. Workers streamline telecommuting by videoconferencing with colleagues in geographically distributed offices.

In the era of DIY’ing all aspects of life, more health citizens are taking to DIY’ing health — and, increasingly, looking beyond physical health for convenient access to mental and behavioral health services.

The Online Couch: Mental Health Care on the Web is my latest paper for the California HealthCare Foundation. Among a range of emerging tech-enabled mental health services is videoconferencing, for which there is a growing roster of choices for platforms that market a variety of features beyond pure communications.

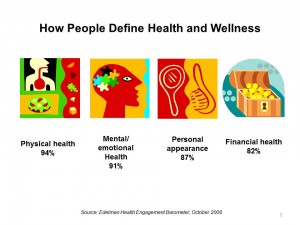

Patient need and demand for therapy to address mild to moderate depression and anxiety is on the rise. And, people include mental health in their overall definition of health and wellness, as evidenced in the Edelman Health Engagement Barometer survey shown in the second graphic.

Patient need and demand for therapy to address mild to moderate depression and anxiety is on the rise. And, people include mental health in their overall definition of health and wellness, as evidenced in the Edelman Health Engagement Barometer survey shown in the second graphic.

As an example of one such platform, I discuss Breakthrough, which is working with two payers in California and plans to expand to other states. However, there are many other organizations targeting the mental health videoconferencing space for providers, including California LiveVisit, CMS Telehealth, Cobalt Therapeutics, COPE Today, E Mental Health Center, HealthLinkNow (which just received a substantial innovation grant from the Centers for Medicare and Medical Services to provide mental health medical home services to patients in Montana and Wyoming), MDLiveCare Health Services, Nefsis, Secure Telehealth, and Voyager National Telepsychiatry Network. The list seems to grow by the month with new announcements in this area that is crowding quickly.

In addition, several communications companies offer enterprisewide platforms directly to groups of providers of psychiatrists, psychologists, counselors and social workers, including AdobeConnect, Abilto, Homepsych, LifeOptions, Polycom, Secure Video Conference, Shepell-fgi, V2VIP, and vSee.

A third fast-growing segment of online therapy targets consumers directly. These include Anxiety Online, iCouch, My Virtual Shrink, Mentaline, Online Therapy, and VIA3, among others.

With this expanding array of options for online and mobile therapy, what’s a consumer or provider to do? Many health plans are incorporating virtual platforms into their mental health offerings, vetting the suppliers in advance of the point-of-prescribing. But some consumers are seeking care themselves, separate from the health care system and sponsoring health plans, paying for services on their own. In these cases, it’s a caveat emptor world where consumers must compare the vendors’ approaches to security and privacy, and the organizations’ vetting of providers’ credentials. There’s not a lot of transparency in this space yet, so for consumers, word-of-mouth and social networks will be informing many peoples’ decisions in this early-adoption phase.

To bolster quality interactions between patients and therapists, the American Telemedicine Association has an expert-guided Telemental Health Special Interest Group that has assembled best practice guidelines on the topic, downloadable from the SIG website.

Health Populi’s Hot Points: There is growing demand for services addressing mild to moderate depression, with people looking for more convenient formats beyond traditional face-to-face therapeutic milieus.

In addition to online videoconferencing, patients looking for help with mild to moderate depression and anxiety might be able to receive services through self-administered computer-based cognitive behavioral therapy (CCBT), mobile health apps, therapy-oriented games, virtual reality, and online social networks. For more on these platforms, and the market forces aligning that are driving this market forward, take a look into the report, The Online Couch: Mental Health Care on the Web.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a