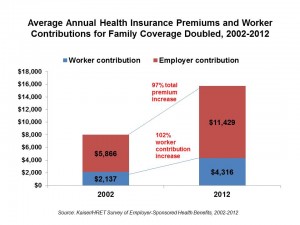

The average annual premiums for employer-sponsored health insurance in 2012 are double what they were a decade ago in terms of both total premium and worker contribution increases. The picture shows the story, according to the 2012 Employer Health Benefits Survey from the Kaiser Family Foundation (KFF). This annual survey polls small, mid-size and large employers to assess their updates for providing health insurance and prescription drug coverage to active and retired employees.

The percentage growth of health costs in the past year were a “modest” 4%, according to KFF. Modest is a relative term: this single digit increase is indeed much lower than the double-digit rises from 10% in 2004 and 13% in 2003. In fact health cost rises have leveled off at 4-6% a year, Drew Altman of KFF points out. There are multiple factors that play into this, including the economic slowdown; health payment reform; and, consumer self-rationing of elective medical tests and procedures, along with postponing prescription drug fills and refills. Still, KFF admits we don’t really know ‘what’ specifically, with certainty, has slowed down cost increases.

What is certain is that consumers are bearing more health care costs, and employers are shifting further toward consumer-directed health plans. In 2012, 19% of employers overall have enrolled workers into high-deductible health plans. HMOs account for 16% of enrollment, PPOs 56%, and point-of-service plans, a small 9% and falling.

Virtually all workers enrolled in employee-sponsored health plans have prescription drug benefits, most of whom (78%) are covered by tiered cost-sharing plans with 3, 4 or more tiers of pricing. These enrollees face copayments of $10 for generic (first-tier) drugs, $29 for second-tier (preferred brands), $51 for third-tier (brands off the formulary), and $79 for fourth-tier (usually high-cost, specialty drugs with special cost arrangements). With the growth of high-deductible health plans, it’s important to note that these workers who have coinsurance vs. copayments face amounts of 20% for first-tier drugs, 26% for second-tier, and 39% for third-tier drugs. Those percents are of retail prices at the point-of-purchase in the pharmacy.

Wellness programs continue to grow among all sizes of employers, with large firms more likely to offer wellness than smaller firms. 63% of firms offer at least one wellness program such as weight loss, biometric screening, smoking cessation, lifestyle and behavioral coaching, gym membership discounts, classes in nutrition and healthy living, web-based resources for healthy living, and/or a wellness newsletter. 94% of large firms do so.

11% of firms offering wellness programs use claims to identify people with health risks, then encourage participation in wellness programs. 35% of large firms do so. 46% of firms offering wellness use health risk assessments (HRAs) to identify workers at-risk of health issues. Among the large firms offering HRAs, 63% offer a financial incentive to employees who complete the HRA. Among these, 11% have required an employee with a health risk factor to complete a health management program in order to avoid a financial penalty (e.g., higher premium contribution or greater cost-sharing). 9% of large firms provide rewards and/or penalties for employees who meet (or don’t) specific biometric outcomes such as target BMI or cholesterol level.

Health Populi’s Hot Points: The topic of health insurance is hot with two additional studies out this week. First, the Employee Benefit Research Institute (EBRI) reports on Sources of Health Insurance and Characteristics of the Uninsured: Analysis of the March 2012 Current Population Survey. Health coverage rates, that is percent of the insured, grew to 82% in 2011. However, employment-based coverage (which was the segment surveyed by KFF) represents a declining share of the insured population. In 2011, 58% of the nonelderly population had insurance through work; in 2000, the percentage was 69%. It’s public sector provided insurance coverage that’s growing (THINK: Medicaid, S-CHIP for kids, and Medicare).

EBRI expects continued erosion of employer-sponsored benefits in 2012 resulting from the economic recession. Until the macroeconomy turns around, EBRI says to look for no rebound in health insurance provided by companies.

The U.S. Census Bureau offers another look at health insurance coverage in its October report, Health Status, Health Insurance, and Medical Services Utilization: 2010. Among people under the age of 65 (that is, below Medicare age), there is a negative relationship between health status and the lack of insurance: people who poor, fair or good health were more likely to be uninsured than those with very good or excellent health. U.S. health citizens with lower incomes and in excellent or very good health had high levels of private insurance coverage compared to people in good, fair, or poor health.

The uninsured also make fewer trips to the doctor, as reported in the Washington Post, and forgo necessary care.

Access to health insurance is a precursor to good health and productivity. As employers’ coverage of health insurance continues to erode, and the economy sputters, health insurance coverage should be seen by policymakers as an economic development strategy. People in poorer health can’t be as productive members of society as those who enjoy good health. It’s a Catch-22: without health insurance for all U.S. health citizens, America’s economy won’t be healthy, either.

Thank you FeedSpot for

Thank you FeedSpot for