The 78% of U.S. adults with primary care physicians (think: medical homes) are very satisfied with their doctors’ visits. The main reasons for this high level of satisfaction include communication (listening, talking), customer service (caring, personable), and clinical (good diagnosis and treatment).

More women than men have a primary care physician relationship, more college grads do, and more people with incomes of $75,000 a year or more do, as well. 90% of those 55 and over have a primary care doctor – a stat heavily influenced by the fact that Medicare coverage kicks in for older people.

This consumer profile comes to us via the report, Consumer Attitudes toward Family/Primary Care Physicians and the U.S. Healthcare System, based on a survey from The Physicians Foundation.

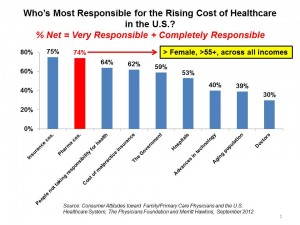

So much for the positive vibes between patients and their doctors. When asked who’s to blame for the rising cost of health care, it’s not the physicians consumers accuse: it’s insurance and the pharmaceutical industry, virtually tied for first place (cited by 75% and 74% of U.S. adults, respectively). Importantly, and realistically, 64% of consumers also say that it’s “peoples’ failure to take responsibility for their health” that’s also a culprit in rising health care costs. This, above malpractice insurance (62%), the government (60%), and hospitals (53%). Technology is blamed as a cost-increaser by 40% of people, and aging, 39%.

Insurance companies are particularly blamed as a negative influence on the quality of health care, as well. 55% of U.S. adults say insurance plans are a negative influence on quality of patient care, with only 27% of people seeing insurance as a positive influence.

While the present is bright, the future of health care in the eyes of consumers isn’t looking so positive: 53% of U.S. adults have a negative attitude about the future of the U.S. health system.

A total of 2,236 adults were interviewed for the survey, among whom 1,807 had a family physician or primary care doctor. The survey was conducted by Harris Interactive in July 2012.

Health Populi’s Hot Points: These results aren’t surprising given where recent past surveys have found consumers’ perceptions on “Big Health” = Big Health Insurance + Big Pharma, down in the trust roster along with Big Oil, Big Tobacco, and Big Food. However, looking toward 2014 as more insurance companies are developing programs to market direct-to-consumer (DTC), there are clearly miles of bridges of trust to build between the industry and potential customers — that is, individual consumers and families — who will be flowing into the coverage pools and seeking to buy plans in Health Insurance Exchanges.

Pharma, long experienced in the DTC world, hasn’t done a superb job at re-building trust with consumers in the past decade. So the insurance industry doesn’t have a model in its brother-pharma to look to for trust-building. Instead, the industry would better look across other vertical markets, such as financial services, telecomms, and automotive, to learn how to re-build trust.

In the meantime, the most trusted relationship for consumers in health remains the physician (outside of friends and family) and the pharmacist (not named in this study, but cited as a positive force for consumer health in a recent survey from AccentHealth). How insurance aligns itself with physicians will be an intriguing question that will be addressed in the coming months. Watch for Aetna, Humana, UnitedHealth, and the many Blues Plans to move in this direction.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a