Consumer price inflation grew 2% between September 2011 and September 2011. The price of branded drugs increased over 13% in the same period according to the Express Scripts 2012 Q3 Drug Trend Quarterly report, issued in November 2012. But the overall trend, including generics, was flat — 0.1%. This, due to the use of generics, now comprising 80% of prescription drug utilization.

Since 2008, the brand prescription price index grew from a base of 100 to 163; the generic index fell from 100 to 61. The CPI index grew from the 100 base to 110.

Generics have proven to be a cost-lowering lever on drug trend over the past year. This impact is helped by new off-patent brands such as Lipitor and Plavix moving into lower-priced generics where consumers pay a much lower-copay out-of-pocket than they do for pricier brand name drugs on either the second (brand on preferred formulary) or third (brand non-preferred off formulary) tiers.

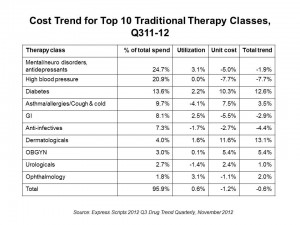

The table organizes cost trends for the top 10 therapeutic Rx classes. The biggest Rx spend on traditional (not specialty) drugs, accounting for 1 in 4 dollars spent in the past year, were for mental health, neurological disorders and antidepressants. Drug trend actually fell for this group by 1.9% as the unit cost for these therapies fell due to generic use of commonly-used antidepressants and antipsychotics.

The second most popular drug class in terms of spend was high blood pressure/heart disease and cholesterol management therapies, where again the cost trend was down 7.7% due to the generic switch of Lipitor and other heart blockbusters over the past several years.

In third place of Rx spending were drugs for diabetes, where costs grew by a whopping 12.6%. Accounting for nearly 14% of drug spend in the past year, spending on therapies for diabetes could explode to the year 2025, when the number of diabetics (currently numbering 24 million people in the U.S.) could double. In addition to taking metformin (a generic drug), many diabetics are also prescribed brand name drugs to add to their therapeutic mix such as Actos (from Takeda, with brand expiration in August 2012), Januvia (Merck), Lantus (Sanofi), or Victoza (Novo-Nordisk).

Another high-growing area in drug trend spending was dermatologicals, which increased by 13.1%.

The big cost increases in drug spending come from specialty drugs, which address complex conditions from cancers to hepatitis C (with the largest trend increase of 117%), respiratory (growing at 35%), and the largest specialty category RA/autoimmune conditions, growing at 25.3%. This last category accounts for nearly 29% of specialty drug spending, followed by therapies for MS which comprise 21% of Rx spending in the specialty category.

Health Populi’s Hot Points: Generic drugs have tempered cost increases for brands to the point where overall cost growth for the Rx line item in health care in the U.S. was flat from 3Q11 to 3Q12. Several popular brand names, like Actos for diabetes, lost their patent in August this year, and we will see additional drugs fall off the so-called Patent Cliff (see my blog on the 3 Cliffs of Health Care, including the fiscal cliff, here).

It’s specialty drug costs that are the stay-up-at-night concern of payers and formulary developers. The high cost of new-new drugs for treating MS, RA, and other complex conditions are a major of cost growth in prescription drug programs. How does a payer make decisions to rule a new-new, expensive therapy into the formulary? Sometimes comparative effectiveness tools can be used where therapies exist for a given class. However, if a therapy is truly “new-new,” then CE really isn’t relevant. Here’s the tough nut to crack in an era of tight resource constraints in health care: who will pay for innovation? What is the value of improved quality of life for a patient to a health plan or self-insured employer? As consumer-patients and caregivers understand the availability of new-new specialty therapies, through their own research and work done by tireless patient advocates, they will pressure payers to provide access to these products via the formulary. When the formulary blocks such access, people will look to the pharma and life science companies to open access to the products through prescription assistance programs. Patients are getting quite smart using social media for these purposes; expect this force only to grow in light of cost pressures on all sides of the health stakeholder equation.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're