This week-after-the-mHealth-Summit gives us the opportunity to synthesize several interesting studies on the state of mobile health in the U.S. with a few days of distance from the excitement of the conference.

Deloitte’s report on mHealth in an mWorld asks how mobile technology is transforming health care. Consumers are driving mHealth growth, Deloitte believes, with mobile apps “enhancing overall consumer engagement” they say. In a future scenario, Deloitte sees health consumers using social health networks for information, motivation and support, self-directing care, and using sensors to monitor and communicate health metrics. Clinicians will have clinical dashboards informed by Big Data analytics, and practice population health management. The health care industry will work cross enterprise, enabling content analytics and deploy productivity tools.

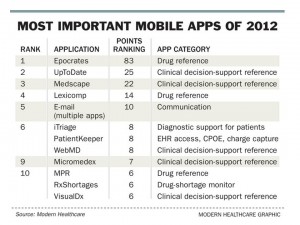

Speaking of apps, Modern Healthcare‘s first survey on the most helpful apps was posted on December 8, 2012, conducted among the magazine’s readers and informed by the Association of Medical Directors of Information Systems (AMDIS) and the College of Healthcare Information Management Executives (CHIME) which represents hospital CIOs.

The chart lists the top ten most important apps in 2012, with Epocrates favorite among the 15,000-some available apps available to mobile health users. This drug reference tool helped drive that category to the top rank of five analyzed by Modern Healthcare: clinical decision support reference ranked a close second, followed by communication, EHR access, and medical education a distant fifth.

The chart lists the top ten most important apps in 2012, with Epocrates favorite among the 15,000-some available apps available to mobile health users. This drug reference tool helped drive that category to the top rank of five analyzed by Modern Healthcare: clinical decision support reference ranked a close second, followed by communication, EHR access, and medical education a distant fifth.

The clinical decision support tools UpToDate and Medscape made #2 and #3 on the list, along with WebMD (in a 3-way tie for #8), Micromedex (#9), and VisualDx (#10, tied 3 ways). Notably, iTriage, the support tool for patients, tied for #8 — the only patient-facing tool of the top 10. iTriage was recently acquired by Aetna for its growing suite of IT tools.

The annual behemoth Consumer Electronics Show will be held in Las Vegas in January 2013, and there will be 25% growth in the health and fitness technology companies showing there. The Consumer Electronics Association survey on health and fitness, which will be published next week, found that 1 in 3 U.S. consumers plans to buy at least one fitness technology in 2013. In 2012, over one-half of U.S. online consumers used a fitness technology — representing 55% growth since 2010, with pedometers the dominant segment. Fitness video games are also fast-growing. Syncing of fitness devices is most commonly done via smartphones (by 31% of consumers using the devices), and usually through wireless or Bluetooth connections.

On the evidence-building front for mHealth were two studies that add to the evidence base. Smartphones used as an adjunct to receiving health coaching for weight loss between clinic visits yielded positive results, published by a team of Northwestern University researchers in the December 10 2012 issue of the Archives of Internal Medicine.

Another positive data point for mHealth was found with text4Baby, the free mobile phone service that promotes maternal and child health through text messaging. This first randomized trial of text4Baby conducted by George Washington University found that pregnant women who received text messages on health topics were nearly three times more likely to believe they were well-prepared to be new mothers versus the control group. The study’s goal was to test whether text messaging could help women understand the importance of not smoking, eating a healthy diet, among other choices that bolster healthy before and after the baby is born.

Another positive data point for mHealth was found with text4Baby, the free mobile phone service that promotes maternal and child health through text messaging. This first randomized trial of text4Baby conducted by George Washington University found that pregnant women who received text messages on health topics were nearly three times more likely to believe they were well-prepared to be new mothers versus the control group. The study’s goal was to test whether text messaging could help women understand the importance of not smoking, eating a healthy diet, among other choices that bolster healthy before and after the baby is born.

Health Populi’s Hot Points: Taken together, these studies point to a market that’s beyond nascency — we’re in the second phase on the mHealth adoption curve beyond the pioneering Quantified Self community, with health providers and clinicians and consumers alike using various flavors of mobile health tools. No one, though, should believe that an mHealth app is the panacea for a broken health system. Mobile is but a platform to transform health care, which it can and will do. But the point isn’t “there’s an app for that.” Many apps are downloaded; few are sustainably used. Epocrates started up in 1998 by two Stanford students, and by 2000 had 100,000 mobile downloads. So the #1 most valued mobile tool is 14 years in the making. Epocrates is a long-trusted brand among clinicians, a kind of killer app in its field.

Consumers might be driving mHealth for fitness, but for “sickness” and medical use it’s going to take a village — that is, the health ecosystem — to see mobile transform health care delivery. EHRs must be able to accept data generated through apps and tools gathered through patients’ observations of daily living — something my own Fitbit and Withings scale can’t do with my own health system’s EHR….yet.

Still, we’re beyond the most-hyped phase of the Hype Cycle in mHealth. We’re gathering evidence to prove what works, and in the accountable and value-based care era, incentives are aligning for adopting mobile apps and tools.

Thank you FeedSpot for

Thank you FeedSpot for