People enrolled in consumer-directed health plans (CDHPs) and high-deductible health plans (HDHPs) are more cost-conscious than those enrolled in more traditional plans, according to Findings from the 2012 EBRI/MGA Consumer Engagement in Health Care Survey from the Employee Benefit Research Institute (EBRI), published in December 2012.

People enrolled in consumer-directed health plans (CDHPs) and high-deductible health plans (HDHPs) are more cost-conscious than those enrolled in more traditional plans, according to Findings from the 2012 EBRI/MGA Consumer Engagement in Health Care Survey from the Employee Benefit Research Institute (EBRI), published in December 2012.

The logic behind CDHPs and HDHPs is that if health plan enrollees have more “skin in the game” — that is, personal financial exposure — they’ll behave more like health “consumers.” By 2012, 36% of employers with over 500 employees offered either HRA- or HSA-eligible plans. About 15% of working age adults are enrolled in either a CDHP or an HDHP.

EBRI’s survey demonstrates that enrollees in these new plan types are more likely to take on a variety of cost-conscious health behaviors, such as taking advantage of wellness programs, using cost information and seeking information about their providers’ costs and quality from sources beyond their health plans, developing budgets to manage health expenses, and using online cost tracking tools.

CDHP and HDHP members tend to be better educated, healthier, less likely to smoke, and more likely to exercise than members in traditional health plans, based on the EBRI/MGA Consumer Engagement in Health Care survey conducted among 4,498 privately insured adults ages 21-64.

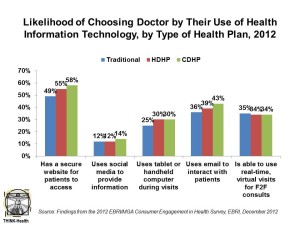

These non-traditional health plan members also more often check whether doctors use health information technology, and are more apt to choose doctors who do when facing a financial incentive to do so. This patient population also more likely uses a smartphone or tablet computer, and one-third report using a health app. Among those who don’t yet use a health app, one-half are interested in using one.

Health Populi’s Hot Points: The new-new finding in this year’s EBRI/MGA survey is consumers’ growing embrace of health information technology — especially when coupled with cost-conscious health behaviors. The chart illustrates that, while nearly one-half of those enrolled in traditional health plans would likely switch to a doctor with a secure website for patients to access test results, make appointments and get health information, a majority of those with CDHPs and HDHPs would likely pick a doctor providing that access. Another interesting data point is the slightly larger plurality of consumers with CDHPs and HDHPs who would like to see doctors using tablets or handheld computers, as well as email for interacting with providers.

Those enrolled in new types of health plans are also more likely to have used a health app more than once via their smartphone or tablet. In particular, the most popular apps for health are those providing nutrition information, general health information, weight management, and exercise programs — consistent with the most recent analysis of consumer-facing health apps by MobiHealthNews.

Those enrolled in new types of health plans are also more likely to have used a health app more than once via their smartphone or tablet. In particular, the most popular apps for health are those providing nutrition information, general health information, weight management, and exercise programs — consistent with the most recent analysis of consumer-facing health apps by MobiHealthNews.

Among people with a smartphone or tablet, consumers are most interested in these sorts of applications for future use, in addition to accessing prices for prescription drugs (50% interested), medical claims history (47% interested), and identifying the balance of the HSA or HRA (54% interested).

When health plan enrollees first accessed consumer-driven plans with the boost of tax incentives in 2003, there weren’t many helpful tools to help people manage their financially-exposed skin in the health care game. A decade has passed, and now patients can take on the mantle of “health consumer” in more empowered ways, thanks to the proliferation of personal health IT tools and better-designed incentive structures (call them ‘nudges‘). We’re not where we need to be for building Patient/Health Consumer 2.0, as U.S. News focused on in this cover story in 2004. It’s going to take a bit longer to build that Smart Patient, but more engaging, user-centered designs for personal health IT are coming onstream. I’ll see more of them next week in Las Vegas at the Consumer Electronics Show and will report from CES on these developments.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for