While 50% of Americans feel they have a sound financial position, the other half is living paycheck to paycheck. 8% say they can’t even pay for essentials.

While 50% of Americans feel they have a sound financial position, the other half is living paycheck to paycheck. 8% say they can’t even pay for essentials.

The second annual Allstate “Life Tracks” Poll finds American adults split between have’s and have not’s, with even the “have’s” feeling less than financially literate.

There is an equal split between people who feel they’re in an “excellent” or “good” financial position compared with those who feel they’re in financially “fair” or “poor” shape. Men feel more financially secure than women; 3 in 4 single parents feel less well-off compared to the average U.S. adult. College grads feel they’re doing better financially those non-grads in the “living from paycheck to paycheck” scenario.

One-half of Americans say they are paying off credit card debt, and 65% of those with credit card debt say that debt has grown or stayed even the past year. Only 15% of people say their long-term savings and investment has increased. Thus, one-half of U.S. adults admit they’re saving less than they “should” be doing.

Even with this less-than-sanguine financial picture, most U.S. adults (9 in 10) feel confident they could manage their personal finances. 4 in 10 believe they could pay for a car, 4 in 10 feel “very” confident they could pay for their kids’ education, and half think they could buy a new house. 91% of Americans told Allstate they believe personal financial management skills can be learned.

You can view a video of “Hank,” the baby who’s marketing financial literacy in Allstate’s campaign, here.

Allstate conducted the survey via phone (landline and cell) among 1,000 American adults 18 and over in December 2012.

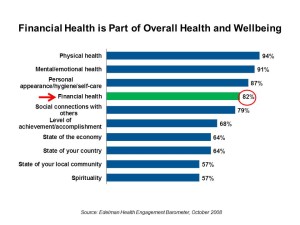

Health Populi’s Hot Points: Financial health is integral to overall health and wellness, as the chart shows. In fact, our feelings about money-in-the-bank as part of our whole health are nearly as important to our personal health equations as our physical health, mental health, and physical appearance, learned via the Edelman Health Engagement Barometer.

health is integral to overall health and wellness, as the chart shows. In fact, our feelings about money-in-the-bank as part of our whole health are nearly as important to our personal health equations as our physical health, mental health, and physical appearance, learned via the Edelman Health Engagement Barometer.

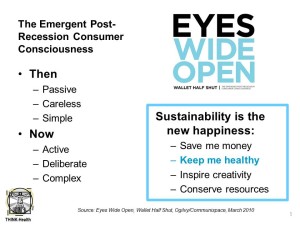

In the post-recession era, we’ve learned that health is also part of our relationships with companies beyond hospitals, pharmas, and over-the-counter consumer medical suppliers. The Ogilvy study, Eyes Wide Open, Wallet Half Shut, looked at how U.S. consumers saw their lives in the advent of the Great Recession of 2008. Their research learned that American consumers were looking for companies to save them money, inspire creativity (THINK: Maker Faire and DIY), conserve resources (THINK: energy/stress reduction), and to “keep me healthy.”

In the post-recession era, we’ve learned that health is also part of our relationships with companies beyond hospitals, pharmas, and over-the-counter consumer medical suppliers. The Ogilvy study, Eyes Wide Open, Wallet Half Shut, looked at how U.S. consumers saw their lives in the advent of the Great Recession of 2008. Their research learned that American consumers were looking for companies to save them money, inspire creativity (THINK: Maker Faire and DIY), conserve resources (THINK: energy/stress reduction), and to “keep me healthy.”

Health is wealth, and wealth, health, in the eyes of U.S. consumers. Most people don’t have the tools to take on saving more, planning for retirement, and grappling with debt. But the Allstate survey found that people feel like they could learn to do so. It will take more than information and a cute video to inspire this sort of sea-change within the hearts and wallets of U.S. health citizens. Connecting the dots between health and wealth could help trigger activation.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for