I can think of 3 reasons why workers at Cummins Engine are blessed:

I can think of 3 reasons why workers at Cummins Engine are blessed:

- They are employed.

- They receive health insurance from their employer.

- They are about to be able to access a tool designed to help them become better health care consumers.

Cummins, based in Columbus, Indiana (far from Silicon Valley), has 24,000 employees and dependents who will be covered by this plan. The company ranked 186 on the Fortune list and has 46,000 employees worldwide. So the firm’s health spending would be in the range of many millions of dollars.

I found the company’s employee health plan HealthSpan offering document online and briefly reviewed it. Based on this, found online here, Cummins offered a $1500 and $3000 high-deductible health plan (HDHP) in 2012 coupled with a health savings account. Prescription drugs were priced, at a retail pharmacy, as follows, once meeting the deductible: 100% coverage for generics plus an $8 copay; for brands on the formulary, 80% of retail price plus a 20% copay ($30 minimum, $150 maximum); and 50% for a brand name not on the formulary, with a $65 minimum and $180 maximum. Mail order prices are more favorable and provide strong incentive to go generic for 90-day refills on maintenance meds. It’s also impressive that the HealthSpan document for 2012 health benefits shows a generous dental plan, increasingly rare these days. There is also an Employee Assistance Program.

The health transparency tool that Castlight Health will provide will complement Cummins’ existing wellness services which include a nurse helpline, a maternity management program, and the wellness program Virgin Health Miles. Cummins’ press release stated that the company would also bring Castlight into the company’s pharmacy benefit program to promote more efficient and effective prescription drug utilization.

Health Populi’s Hot Points: OK, so I count my blessings in terms of health and health care. But health is indeed a person’s #1 asset, requiring feeding and investment.

Services that help us better manage our health help nurture health-as-asset. Services that help us manage our personal financial health twice-bless. Why? Because our financial health feeds into our self-perceptions of whole health and wellness.

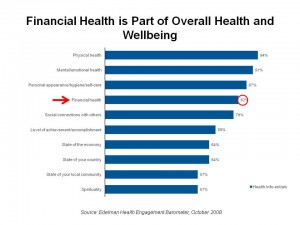

Let me remind you of an important piece of data that’s (hard to believe) 5 years old now from the first Edelman Health Engagement Barometer: that 3 in 4 people consider their financial health tightly bundled into their personal definition of health and wellness. The other top areas people use to define health and wellbeing are first, physical health, followed by mental health, appearance, and then financial, as shown in the chart.

Let me remind you of an important piece of data that’s (hard to believe) 5 years old now from the first Edelman Health Engagement Barometer: that 3 in 4 people consider their financial health tightly bundled into their personal definition of health and wellness. The other top areas people use to define health and wellbeing are first, physical health, followed by mental health, appearance, and then financial, as shown in the chart.

Cummins Engine appears to be engaging with employees on this level. As more employers adopt consumer-directed health plans — coupling high deductibles with wrap-around health savings accounts and other medical savings vehicles — companies should enable workers to embrace their new consumer-hood through useful and engaging tools to help manage their personal health financial line item. In that way, they’ll be aligning the fiscal with the physical, together driving whole health.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a