The prescription drug cost curve is bending…for the time being. Spending on medicines fell by 3.5% in 2012 and will continue to fall below overall health spending over the next five years to 2017.

The prescription drug cost curve is bending…for the time being. Spending on medicines fell by 3.5% in 2012 and will continue to fall below overall health spending over the next five years to 2017.

But different from general health spending, there’s a new game in town called specialty medicines, and they cost a whole lot more than the generics and the aging brands that bent the cost curve in 2012.

The declining Rx spending story is only part of a complicated tale told in great detail in a comprehensive report from the IMS Institute for Healthcare Informatics, Declining Medicine Use and Costs: For Better or Worse, a review of the use of medicines in the U.S. in 2012.

What’s driven prescription drug spending down is the inexorable growth of generics, now comprising 84% of market share and expected to reach 87% in 2017, IMS forecasts. Patent expiries contributed 30% of the rise in generic share in the past decade. When a generic form of an Rx is available, it is dispensed 95% of the time.

Tempering cost savings in 2012 was increased spending on new drug brands: in 2012, spending on new prescription products (less than 24 months on the market) of $10.8 bn, driven by specialty drugs for hep C, macular degeneration, bone metastases in cancer, MS, and inoperable/metastatic melanoma.

Tempering cost savings in 2012 was increased spending on new drug brands: in 2012, spending on new prescription products (less than 24 months on the market) of $10.8 bn, driven by specialty drugs for hep C, macular degeneration, bone metastases in cancer, MS, and inoperable/metastatic melanoma.

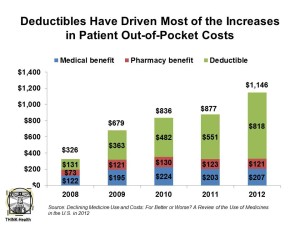

Patient payment is shifting to higher deductibles, copays and coinsurance, with new kinds of insurance products like consumer-directed health plans (CDHPs) driving greater consumer financial responsibility. Deductibles and out-of-pocket (OOP) costs more than tripled for insured patients over the past five years, and costs for people in CDHPs went up seven times in the five years. The second chart illustrates the fact that deductibles for Rx have increased dramatically to $818 in 2012.

Health Populi’s Hot Points: “Patients’ exposure to rising out-of-pocket costs may be having an effect on their utilization of healthcare services,” IMS writes.

Welcome to the new world of consumer-directed prescription drugs.

In 2008, 8% of consumers were enrolled in CDHPs; in 2012, 10% of the insured had a CDHP.

Furthermore, “the design of a typical PPO plan has changed over the past 5 years,” IMS opines, where “a PPO plan largely resembles a CDHP, and may include deductibles over $1,000 and co-insurance of more than 20% for medicines.”

On the upside for patients, more are paying under $10 for prescriptions than they did five years ago due to the growth of generic substitution and the decline of branded drugs.

Good news for patients on the clinical front is that the 9 new molecular entities to treat cancers launched in 2012 is the greatest number brought to market in 10 years. These include treatments for breast cancer, renal cell carcinoma, colorectal cancer, chronic myeloid leukemia, myeloma, prostate cancer, non-small cell lung cancer, and soft tissue sarcomas. One for breast cancer, Kadcyla, was approved in February 2013 and is considered a “smart bomb” to combat the disease in a targeted way.

Oncologics — drugs to treat cancers — are the biggest spending area for prescription drugs, accounting for $25.9 bn in 2012 and projected to have a 7.8% growth rate.

The IMS data parallel other health spending data showing declines, with several prominent health economists hypothesizing this could represent real structural change in the health economy.

There are two market factors to keep in mind going forward which could counteract the decline in pharma spend:

- The approval and growth of specialty drugs for cancer and autoimmune conditions, along with molecules addressing rare diseases, will seek to command very high price tags in the tens of thousands of dollars per year.

- Consumers enrolled in CDHPs and artfully-designed Rx benefit plans will grow.

These forces will shape the microeconomy of prescription drugs and will play out across different disease states and health plan types in complex ways. But one thing is certain: as consumers pay more out-of-pocket for these new-new products, they will need to understand their value in their own life cycle.

Thank you FeedSpot for

Thank you FeedSpot for