While there is big uncertainty about how health reform will roll out in 2014, and who will opt into the new (and improved?) system, health cost growth will slow to 6.5% signalling a trend of moderating medical costs in America. Even though more newly-insured people may seek care in 2014, the costs per “unit” (visit, pill, therapy encounter) should stay fairly level – at some of the lowest levels since the U.S. started to gauge national health spending in 1960.

That’s due to “the imperative to do more with less has paved the way for a true transformation of the health ecosystem, from fee-for-service medicine to consumer-centered care that rewards quality outcomes,” PwC asserts in Medical Cost Trend: Behind the Numbers 2014, published June 18, 2013.

What’s led to the health cost slowdown is a combination of four factors, PwC says:

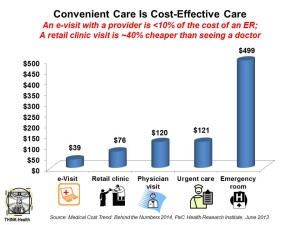

- Health care moving from higher cost inpatient hospital settings to lower cost retail clinics and mobile health. See the chart for the average cost differential between, say, and ER visit versus a retail clinic visit: $499 compared to $76.

- Employers directly contracting for health services with “Centers of Excellence” considered to be high performers in their specialties. Examples of this trend are the Mayo Clinic and Walmart working together on transplant care., and Johns Hopkins Health System and Pepsi working on cardiac care and joint replacements.

- The Affordable Care Act’s penalties on hospital readmissions for pneumonia, acute myocardial infarction and congestive heart failure; readmissions fell by about 70,000 patient admissions based on government data, PwC found.

- The growth of high-deductible health plans for employees, where consumers pay more out-of-pocket for care which rationalizes (and sometimes rations) care and, thus, lowers costs. PwC notes that 44% of U.S. employers are considering offering only high-deductible health plans in 2014. For more on this trend, see yesterday’s Health Populi on the growth of account-based health plans.

PwC asks in the conclusion of the report whether the health industry can “continue on the path to full transformation” and keep bending the cost curve.

Health Populi’s Hot Points: PwC ends the paper with implications for 4 key stakeholders:

- Employers, who are shifting more financial responsibility for health onto employees.

- Providers, who can reach into their local communities to provide care in more convenient and cost-effective channels.

- Health insurers, who are coordinating the providers (doctors and hospitals) and “empowering consumers to make cost-efficient choices.”

- Pharmaceutical and life science companies which are coordinating more closely with insurers and providers (prescribers).

Whither the patients, consumers, and caregivers in this “transformation?” That’s where the heaviest lifting will be: for these stakeholders to inspire and support self-care, those ‘cost-efficient choices’ PwC mentions in the health insurers’ discussion, and greater focus on wellness and behaviors that socialize good health in families, neighborhoods and social networks. This will involve greater transparency, social responsibility, engaging formats and communication, and partnering with patients where they live, work, play and pray — beyond the workplace.

That’s how the cost-curve gets bent on an annual and ongoing basis.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a