There’s an issue that doctors and patients don’t discuss that’s among the most important contributors to ill health: it’s money, and it’s something Alexandra Drane calls an “Unmentionable.”

Alex, Founder, Chief Visionary, and Board Chair at Eliza Corporation, coined Unmentionables as those aspects of daily living which everyone deals with, but few like to talk about: like sex (whether too much, too little), drugs (abusing), drinking (too much), toileting problems (such as incontinence or pooping problems), sleep trouble, and caring for others (not ourselves so much). These daily life challenges can negatively impact health, with financial stress being one of the prime and most ubiquitous stressors among all of the Unmentionables.

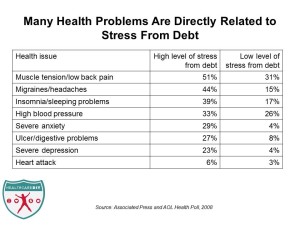

I spent time last week with Alex and her team brainstorming these aspects of health – where people live, work, play, pray, and sleep, and not in the doctor’s office – and revisited Helping Employers and Employees Navigate the Health/Wealth Convergence, from Manning & Napier, published in February 2013. Based on the update on the Unmentionables, and the sputtering U.S. economy as reported by Fannie Mae (and notwithstanding a relatively bullish stock market in the first half of 2013), I dug out the chart included in the report which speaks to the impact of stress and debt on health from an AP/AOL Health Poll.

Specifically, people relate high levels of stress from debt to some major health issues, including back pain, migraines and headaches, sleeping problems (one of the Unmentionables in and of itself), anxiety, gut issues, and depression. The incidence of high blood pressure is somewhat elevated in stress-filled people, but in peoples’ minds, it’s not as directly related to money stress as these other health conditions are.

An individual’s financial problem impacts their individual health, but it’s also a driver for employers’ health costs: The American Psychological Association Practice Organization published research in 2010 attesting to this fact. And, financial distress is a strong precursor to workplace absences – another cost for employers to consider.

Health Populi’s Hot Points: The solution to the health/wealth challenge is multi-pronged. Americans tend not to save to the extent that other nations’ citizens do; to extend credit beyond Suze Orman’s sound recommendations to eliminate debt; and, to avoid health and health plan literacy compared to other shopping literacy like knowing how to buy a washing machine or automobile, or take out a home mortgage.

The interconnection between health and money is huge and must be mentioned, often, so that it’s not taboo. This is a society-wide issue that goes well beyond the impact on an individual American health citizen and her family. It impacts her community, her workplace and employer, and the unbending nature of U.S. health care costs. Promoting savings to make it more sexy would provide a buffer to sleeplessness, turning to alcohol and substances, headaches and backaches. And probably promote better sex lives, as well. Empirical evidence to follow!

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're