Most older Americans 60 years of age and up (57%) say the last year of their lives has been “normal” – a large increase from the 42% who said life was normal in 2012. And nearly 9 in 10 older Americans are confident in their ability to maintain a high quality of life in their senior years.

Most older Americans 60 years of age and up (57%) say the last year of their lives has been “normal” – a large increase from the 42% who said life was normal in 2012. And nearly 9 in 10 older Americans are confident in their ability to maintain a high quality of life in their senior years.

The good news is that seniors are maintaining a positive outlook on aging and their future. The downside: older people aren’t doing much to invest in their future health for the long run. They’re also worried about the financial impact of living longer.

The United States of Aging, brought to us by the National Council of Aging, UnitedHealthcare and USA Today, paints a picture of American older adults who are sanguine in the short run – but underneath lies a current of concern for living longer and what that future holds for their health and personal finances.

Some of the most interesting and perhaps surprising points in the study are that:

- 83% of seniors say it’s important to use technology, with 75% of all people over 60 having a mobile phone. 54% of low-income and older seniors have cell phones. The biggest barriers to using more tech for older people are not understanding how to use it and cost, both cited by about one-half of seniors polled.

- 67% say they’ve never felt isolated from other people

- 40% say staying connected to family and friends is most important to having a high quality of life

- Most seniors are living independently doing regular activities.

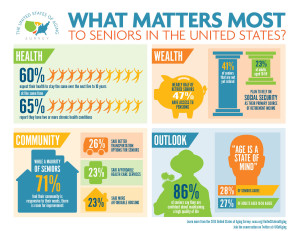

65% of people over 60 years old report having 2 or more chronic conditions – with 44% having 3 or more. 60% of older people say their health in the last year stayed “normal,” and another 22% said health got worse — though many fewer than in 2012 (when 34% said their health got worse over the previous year) — a move in the right direction toward healthier aging.

So much for positive perceptions of health. The other side of this coin, with longer-term implications, is that 51% of seniors 60 and over have not set goals to manage their health, 43% haven’t taken steps toward preventing falls, and 18% never exercise — never – for 30 minutes or more.

On the financial side of life, 53% of seniors over 60 are concerned about whether their savings and income will be sufficient to last for the rest of their life – 22% very concerned and 31% somewhat concerned. One-third aren’t concerned about future finances.

Health Populi’s Hot Points: Among seniors who have set goals to manage their health, 64% are rated as optimistic — seniors who expect their overall quality of life to improve in the next 5 to 10 years, compared with 47% of the overall national sample of seniors.

That quality of life is defined by people over 60 in at least 3 dimensions: staying connected to family and friends, having financial means, and staying mentally active.

Seniors who have lower-incomes have more barriers to being optimistic: health and wealth are intertwined, a phenomenon which Health Populi has highlighted since the inception of this blog:

- 74% of low-income seniors have a barrier in managing their health condition vs. 52% of the national senior average

- 27% of low-income seniors never exercise for 30 minutes or more, compared with 18% of the national senior population

- 20% of low-income seniors are not confident they can keep health issues from interfering with their life, vs. 9% of national seniors

- 8% of low-income seniors haven’t seen a health care professional in the past year, vs. 3%.

These very people who most need health and financial tools and counsel are the least well-served by the U.S. health and financial systems. I spent time with Fard Johnmar of Enspektos (@fardj on Twitter) and his webinar, The Rise of Just-in-Time Health Information Systems. The vision of JiTHIT is for people to receive personalized information passively, without their having to search for it themselves. Sometimes people will receive information even before they need it. This is powerful for health: consider the power of passive sensors collecting your personal health metrics (e.g., blood pressure, sugar in urine via smart toilet, physical activity, weight, and food intake), where data is being collecting and communicated through the cloud to a smart black box (say, a disease management risk calculator for diabetes or congestive heart failure). You, the patient, consumer or caregiver, would then receive a text message or phone call to increase your diuretic (in the case of CHF), get up off of the couch and take a walk (for weight loss), or increase your insulin dose (for more effective diabetes management). For more on the use of sensors and health, see Making Sense of Sensors in Healthcare, my paper published by the California HealthCare Foundation earlier this year.

Until that vision proliferates, in the meantime, we’re a Shopping Nation with a growing retail health sector, so to deal with the health/wealth issue and consumerization of health in America, there’s a kind of Madison Avenue zeitgeist happening at the intersection of health and seniors. This week, Rite-Aid unveiled its advertising campaign Wellness65+, featuring a video of a grandma playing watergun tag with her grandson, clipped here. Walgreens is trying to attract more older people to its rebranded Health Clinics, renamed from TakeCare Clinics, which traditionally attract families with kids and the uninsured.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a