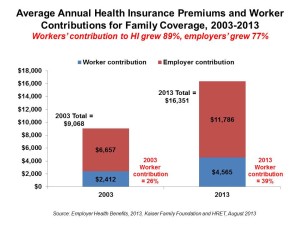

Insurance premium costs grew 4% for families between 2012 and 2013, with workers now bearing 39% of health premiums in 2013 compared with only 26% ten years ago, in 2003. That’s a 50% increase in health plan premium “burden” for working families, by my calculation.

This snapshot of health insurance in 2013 comes to us from the 2013 Employer Health Benefits Survey, provided by the Kaiser Family Foundation (KFF) and the Health Research & Educational Trust (HRET).

This research is one of the most important annual reports to hit the health care industry every year, and this year’s analysis provides strategic context that sets the stage for the implementation of the Affordable Care Act.

The top-line finding in the report is that 57% of companies offered employers health insurance in 2013, falling from 61% in 2012. 62% of workers are covered by their companies. However, for those health plans “grandfathered” by the Affordable Care Act (ACA), coverage of workers fell from 65% in 2011 to 48% in 2012 and 36% in 2013.

78% (more than three-quarters) of covered workers have some kind of deductible associated with their health plan, a statistically significant increase from 2012. The average deductible for covered workers in small firms is $1,715, up from $1,596 in 2012; for workers in large firms, the average deductible remained fairly flat at $884. That 58% of workers in small businesses (firms under 200 workers) are enrolled in a high-deductible health plan of $1,000 or more for single coverage is a huge increase from 2012, when 49% of workers in small companies had HDHPs of at least $1,000. Those workers covered by HDHPs in large firms inched up from 26% to 28%, with about 38% of workers across all size firms now enrolled in HDHPs with deductibles of $1,000 or more.

Wellness programs continue to grow among employers, with three-fourths of firms of all sizes offering them, 24% providing health risk assessments, and 57% with at least one disease management program. Financial incentives remain a pioneering tactic for motivating workers to participate in wellness activities at work. 36% of large firms offer incentives for employees who participate in at least one wellness program. 54% of large firms offer an incentive to complete a health risk assessment.

Among large firms, the most popular wellness programs offered are:

- Flu shots, among 87%

- Employee assistance programs (EAPs), in 79%

- Web-based resources for healthy living, for 78%

- Smoking cessation, in 71%

- Gym membership discounts or on-site exercise facilities, for 69%.

In addition, 58% of large companies offer weight loss programs, and 55% biometric screening.

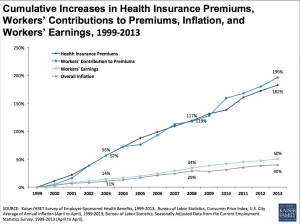

Health Populi’s Hot Points: The aggregate rise in the cost of health insurance premiums over the past decade has been about 140% overall, with workers’ contributions about 134%. At the same time, the cumulative increase in workers’ wages has been about 36% over the 10 years, 2003-2013.

Health Populi’s Hot Points: The aggregate rise in the cost of health insurance premiums over the past decade has been about 140% overall, with workers’ contributions about 134%. At the same time, the cumulative increase in workers’ wages has been about 36% over the 10 years, 2003-2013.

While the top line finding of this study is that most employers who offered health insurance in 2012 still offer it in 2013. At the same time, the growth of consumer-directed health plans, and in particular the dramatic increase in high-deductible plan offerings, coupled with flat wages, means that employees are bearing more financial burden for health care.

The trend toward employers’ offering consumer-driven plans looks to continue into 2014 and beyond, given that 61% of employers believe CDHPs are cost-effective in containing health insurance costs, found in the 2013 KFF/HRET survey.

Furthermore, 50% of employers said “higher employee cost sharing” is also an effective strategy for keeping health costs down.

Consumers receiving health insurance through the workplace will surely bear more skin in the health insurance game, with wages remaining flat. Health care costs will therefore compete in the American household budget with food, shelter, housing and energy line items in and beyond 2013.

Responsibilities among consumers will also increase in that they may face more choices across health plan options once the Health Insurance Exchanges (public and private) launch on January 1, 2014. The theory of skin in the game will be tested on the exchanges, where some workers may opt for very high-deductible health plans (of $5,000) and will be stretching new muscles managing that much-higher deductible. A story in Kaiser Health News earlier this month highlights just how painful that muscle-stretching could be for some insured people.

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast