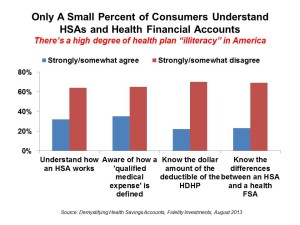

Most Americans don’t understand what a health savings account (HSA) is – including people who are enrolled in the plans.

Most Americans don’t understand what a health savings account (HSA) is – including people who are enrolled in the plans.

While health literacy is generally acknowledged to be a public health challenge in America, health insurance literacy is not well recognized. Yet in the emerging consumer-directed health plan era of U.S. health care, peoples’ lack of understanding of health financial accounts will get in the way of people who really need care seeking care at the right time.

This leads to greater health spending later when the consumer-patient can develop a health condition that could have been prevented (say, pre-diabetes moving into diabetes) or a Stage 1 cancer diagnosis moving to a more serious phase of illness.

Demystifying Health Savings Accounts details Fidelity Investments’ findings from a February 2013 survey of U.S. working-age adults, finding a great deal of cluelessness when it comes to knowing the practical aspects of HSAs, flexible spending accounts (FSAs), and deductibles: the building blocks of plans that will be offered by employers in 2014, and in the health insurance marketplaces that will go live on January 1, 2014 as part of health reform.

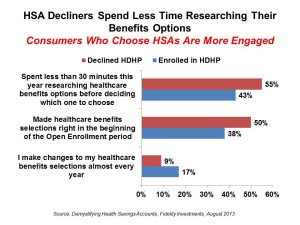

Fidelity found that people who do enroll in HSAs have spent more time studying their plan options. Once enrolled in an HSA, people are satisfied with the plans and most look to re-enroll in an HSA next year. The most favored reasons for enrolling in an HSA were financial incentives such as HSA funds being able to be carried over to the next year (cited by 48% of enrollees), and lower premiums for health insurance (noted by 45% of enrollees). 38% of HSA enrollees also like the tax savings feature of an HSA.

When asked several true-or-false questions about HSAs, most consumers were unsure of the answers for whether HSAs can be used to pay for insurance premiums or as long-term savings vehicles; or, whether HSAs are the same thing as FSAs.

Fidelity Investments worked with GfK to conduct 1,836 interviews with U.S. adults between 25 and 62 with incomes of at least $25,000 in February 2013.

Health Populi’s Hot Points: While employers and plan sponsors offering HSAs provide “information” during enrollment periods that detail health plan options, it’s clear that workers don’t behave like real consumers when enrolling in plans. I use the word “enroll” quite purposefully here because it’s distinct from the verb “shop.” In the consumer-oriented health world that’s growing in both public and private health marketplaces (exchanges), the ability for a person to “shop” for a health plan that will best work for them is a required skill.

Health Populi’s Hot Points: While employers and plan sponsors offering HSAs provide “information” during enrollment periods that detail health plan options, it’s clear that workers don’t behave like real consumers when enrolling in plans. I use the word “enroll” quite purposefully here because it’s distinct from the verb “shop.” In the consumer-oriented health world that’s growing in both public and private health marketplaces (exchanges), the ability for a person to “shop” for a health plan that will best work for them is a required skill.

Yet, as shown in the second chart, Fidelity has found that most people who declined a high-deductible health plan spent less than 30 minutes studying their health plan options, compared with people who enrolled in an HDHP.

People who declined the HDHP or enrolled in a traditional plan are looking more to online tools, their partners at home, and online research to help support their decisions – and less to employers. These health consumers aren’t finding sufficient information to help them understand the benefits of the health benefits via the channels they want to use and the messages they want to hear.

This results in inertia and same-old same-old health benefits behaviors in two key respects:

- Enrollees are less satisfied with their health plan experience

- Enrollees can be spending more money than they need to by not exploiting the benefits to which they’re entitled.

As a result, plan sponsors/employers aren’t optimizing their spending on health insurance benefits as they look to bend their medical trend cost curve through bolstering consumer-driven health and shared decision making.

Meet people where they want to be met: with messages and via media they’re already using. Keep it simple, keep it real and authentic. That’s where health engagement begins.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for