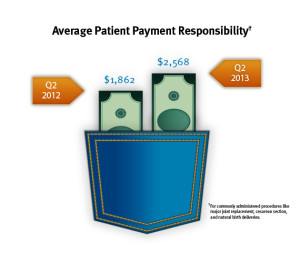

People who received health care in the U.S. between the second quarters of 2012 and 2013 faced 38% higher out-of-pocket costs, growing from $1,862 to $2,568 in just one year. These were payments for common procedures like joint replacements, Caesarean sections, and normal births.

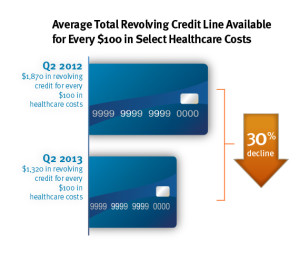

At the same time, consumers’ access to revolving credit lines fell by $1,000 over the twelve months. (Credit lines here include bank-issued credit cards, store credit cards, and home equity loans).

The TransUnion Healthcare Report from TransUnion, the credit information company, paints a picture of tightening money for all consumers in the face of rising household medical costs for health consumers.

For example, the cost of C-section births averaged about $2,224 in the second quarter of 2013, compared with about $1,477 in Q2-2012. That’s about a $750 change equal to a 53% growth in C-section costs. At the same time, the average total revolving credit line in dollars fell from about $34,800 down to $33,900. Natural birth costs grew 45% in the year, and major joint replacement OOPs, 24%, between Q2-2012 and -2013.

Average deductibles in Q2-2013 were about $11,500 rising from roughly $800 in Q2-2012 – an 88% increase. Concurrently, the average total revolving credit in dollars fell from about $34,750 to $33,900.

TransUnion Healthcare reviewed data from 200 U.S. hospitals looking at patient payments for C-sections, major joint replacement and natural birth deliveries. This was compared with data from TransUnion’s Industry Insights Report on credit markets.

Health Populi’s Hot Points: The second image illustrates TransUnion’s ratio of credit vs. healthcare costs for the 3 compared procedures. The bottom-line here is that American households’ finances are so pressured that payments to health providers will probably be rationed to balance with other household cost-commitments like housing, energy, and food. For every $100 in health costs, consumers had $1,320 in revolving credit potentially make those payments, the company calculated. This is a 13.2 ratio as of the second quarter of 2013. In the same quarter of 2012, just one year before, that ratio was 18.7 – signalling that peoples’ purchasing power was 30% greater last year.

Health providers should anticipate even greater financial pressure from patients unable to pay for services in 2014 as greater consumer-directed health plans – featuring high-deductibles and health savings accounts – grow in prominence in both private health plans sponsored by employers as well as those purchased on health insurance marketplaces/exchanges.

Since the advent of the Great Recession of 2008, most U.S. adults have done something to self-ration health care due to costs. People need tools to help them better manage their financial and physical health. For example, one common strategy to manage health costs has been to delay filling prescriptions, split pills or skip doses to save money on medicines. A helpful tool to enable people to find value-priced drugs is GoodRx, a mobile health app that enables patients prescribed a drug to see if there is an available generic substitute, find local pharmacies that carry the drug comparing prices and out-of-pocket costs, and provide a map to the store — all in one, streamlined app instead of 3 or 4.

For managing HSAs and deductible tracking, consumers can tap into health-financial management apps like Simplee and CakeHealth which position themselves as “Mint.com’s” for helping people manage medical finances.

It would behoove hospital and health care CFOs to “prescribe” these apps to patients in their local health ecosystems to enable (1) people to better health-finance engage and (2) for the CFOs to enhance their revenue cycle management. At the end of the day, financial health for all will better health outcomes for individuals and their communities.

For more health shopping tips, see Shop Smart on HealthcareDIY.

Thank you FeedSpot for

Thank you FeedSpot for