We who are charged with forecasting the future of health and health care live in a world of scenario planning, placing bets on certainties (what we know we know), uncertainties (what we know we don’t know), and wild cards — those phenomena that, if they happen in the real world, blow our forecasts to smithereens, forcing a tabula rasa for a new-and-improved forecast.

There are many more uncertainties than certainties challenging the tea leaves for the new year, including the changing role of health insurance companies and how they will respond to the Affordable Care Act implementation and changing mandates and rules; employers’ longevity in their role as health insurance sponsor and wellness advocate for workers; physicians’ ability to stay in practice with physicians as partners, or whether the trend of physicians throwing in with hospitals will continue; and, the pace of change of value-based benefits with true managed care components (like paying for performance or outcomes, bundling payment, and paying for population health), versus the continuation of modified fee-for-service reimbursement (that is, volume-based payment).

For 2014, there is a handful of certainties and lots of grey area for guessing. The certainties are:

- The continued shift of financial risk (that is, costs) to health care consumers

- The growth of self-care among consumers

- The proliferation of self-health devices and tools for consumers.

These 3 certainties are quite interrelated.

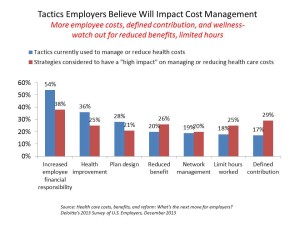

1. The continued shift of financial risk to health care consumers. We’ve covered this trend for the past several years here on Health Populi; most recently, we assessed the survey on employer-sponsored health benefits by Deloitte which found that more work-based health benefit designs will move toward defined contribution, with increased worker cost-sharing, along with concerted efforts to motivate employees’ lifestyle behavior changes to lower health risks via wellness programs and the use of behavioral economic incentives. The Aon Hewitt employer health survey released in October 2013 talked about this trend as “migrating” risks to employees. As newly-insured people sign up for new plans on Health Insurance Exchanges, these insurance newbies will generally face a choice of high-deductible health plans coupled with health savings accounts where folks will be spending “their” money up to the deductible limit before plans kick in coverage.

1. The continued shift of financial risk to health care consumers. We’ve covered this trend for the past several years here on Health Populi; most recently, we assessed the survey on employer-sponsored health benefits by Deloitte which found that more work-based health benefit designs will move toward defined contribution, with increased worker cost-sharing, along with concerted efforts to motivate employees’ lifestyle behavior changes to lower health risks via wellness programs and the use of behavioral economic incentives. The Aon Hewitt employer health survey released in October 2013 talked about this trend as “migrating” risks to employees. As newly-insured people sign up for new plans on Health Insurance Exchanges, these insurance newbies will generally face a choice of high-deductible health plans coupled with health savings accounts where folks will be spending “their” money up to the deductible limit before plans kick in coverage.

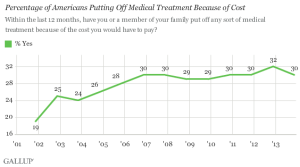

2. The growth of self-care among consumers. Cost burdens growing on people is forcing their morphing into health care consumers — some people more effectively than others. Gallup’s latest poll from early December 2013 found that at least 30% of American adults are foregoing health care due to costs. The Kaiser Family Foundation has been tracking the self-rationing health care behavior among people over 18 years of age to find that over 50% of people do ‘something’ to postpone, forego, or self-ration health care services due to cost since the advent of the 2008 Great Recession. These choices take the form of skipping recommended medical tests, not filling prescriptions written by personal physicians, splitting pills against medical instructions, and not seeing the doctor even when one feels sick. On the other hand, the growth of self-care through buying and taking vitamins/minerals/supplements, spending money on gluten-free and organic food to benefit health (even when health evidence is scant), and the use of over-the-counter meds for pain, allergy, and sleep, are on the rise. In addition, beyond retail spending, it’s mainstream behavior for people to self-diagnose via search engines and websites for themselves or people they care for.

2. The growth of self-care among consumers. Cost burdens growing on people is forcing their morphing into health care consumers — some people more effectively than others. Gallup’s latest poll from early December 2013 found that at least 30% of American adults are foregoing health care due to costs. The Kaiser Family Foundation has been tracking the self-rationing health care behavior among people over 18 years of age to find that over 50% of people do ‘something’ to postpone, forego, or self-ration health care services due to cost since the advent of the 2008 Great Recession. These choices take the form of skipping recommended medical tests, not filling prescriptions written by personal physicians, splitting pills against medical instructions, and not seeing the doctor even when one feels sick. On the other hand, the growth of self-care through buying and taking vitamins/minerals/supplements, spending money on gluten-free and organic food to benefit health (even when health evidence is scant), and the use of over-the-counter meds for pain, allergy, and sleep, are on the rise. In addition, beyond retail spending, it’s mainstream behavior for people to self-diagnose via search engines and websites for themselves or people they care for.

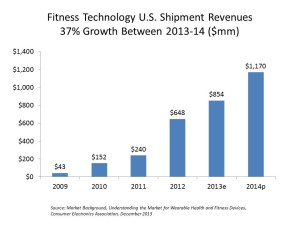

3. The proliferation of self-health devices and tools for consumers. Next week, the 2014 Consumer Electronics Show will host thousands of in-bound visitors to Las Vegas to learn more about digital health, electronics for seniors (at the “Silver Summit”), and the growth of the connected home wired for personal emergency responses and an infrastructure that could (could) support advanced home care applications. The digital health area of the 2014 CES grew 25% last year from 2012 to 2013, and 40% this year from 2013 to 2014’s floor space at the Las Vegas Convention Center. From Best Buy to Walmart, and retailers in-between “B” and “W,” we’ve already seen the offerings of mobile health devices on pre-holiday advertisements in Sunday newspapers, from USB-enabled heart rate monitors and Wi-Fi weight scales to more wristbanded activity trackers than one human has the physical capacity to wear on their right and/or left forearm. This latter category of so-called “wearables” will grow with the expansion of smartwatches from Apple and Samsung as well as smaller innovators, enlarged product lines from Fitbit, Jawbone and Withings (among many others), and new entrants the names of which we’ll divulge next week once embargoes come off of press releases. It remains to be seen how many new adopters of these technologies will reach into their pockets and spend disposable income on new, shiny things for health care. (See my take on mobile health adoption here with the proviso, “don’t over-forecast mobile health in the short-run”).

3. The proliferation of self-health devices and tools for consumers. Next week, the 2014 Consumer Electronics Show will host thousands of in-bound visitors to Las Vegas to learn more about digital health, electronics for seniors (at the “Silver Summit”), and the growth of the connected home wired for personal emergency responses and an infrastructure that could (could) support advanced home care applications. The digital health area of the 2014 CES grew 25% last year from 2012 to 2013, and 40% this year from 2013 to 2014’s floor space at the Las Vegas Convention Center. From Best Buy to Walmart, and retailers in-between “B” and “W,” we’ve already seen the offerings of mobile health devices on pre-holiday advertisements in Sunday newspapers, from USB-enabled heart rate monitors and Wi-Fi weight scales to more wristbanded activity trackers than one human has the physical capacity to wear on their right and/or left forearm. This latter category of so-called “wearables” will grow with the expansion of smartwatches from Apple and Samsung as well as smaller innovators, enlarged product lines from Fitbit, Jawbone and Withings (among many others), and new entrants the names of which we’ll divulge next week once embargoes come off of press releases. It remains to be seen how many new adopters of these technologies will reach into their pockets and spend disposable income on new, shiny things for health care. (See my take on mobile health adoption here with the proviso, “don’t over-forecast mobile health in the short-run”).

Health Populi’s Hot Points: 2014 will be the tipping point year for defined contribution health plans, foresees Peter Orszag, and I quite agree. The health plan micro-economy is moving from defined benefit (where plan sponsors [employers, unions, and governments] choose and pay for a specific menu of benefits for workers) to defined contribution (DC), where financial risks are borne by the worker. In this migration of risk from company/plan sponsor to beneficiary, people must develop new muscles to effectively become and act as health consumers: in researching the benefit, identifying quality health providers, signing up with physician practices, and accessing services when clinicians say people should get them.

At any of these links in the new DC health economic value-chain, that consumer health work flow may disconnect: people might decide the cost of a particular therapeutic recommendation is too great to allocate spending on (per the Gallup and KFF survey findings cited above). A caregiver might sacrifice her own care-spending for her child or spouse in a particular month when money feels especially tight. Or, the insured person, facing a high-deductible and a daunting number of choices on a long list of providers, might opt not to spend time studying options the way he might do for a new car or washing machine.

While the uncertainties of employers continuing to sponsor health care, the ups-and-downs of ACA implementation, and physician business survival are up in the air in our scenario planning exercises, here are 3 certainties you can count on for health in America in 2014.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a