Charges for medical, pharmacy and dental services can vary by more than 300%. This means that in one place, a procedure that costs $100 can cost $300 for the same treatment in another location or practice, discovered by Change Healthcare in their latest Healthcare Transparency Index 2013 Q3 Report, published in January 2014.

The 300% is the average overall across dozens of health services used by the 67,000 plan members Change Healthcare analyzed based on health plan enrollees’ health care utilization in the third quarter of 2013. These health care services include office visits (behavioral health, physical therapy and chiropractic, eye care, pediatrics, primary care, specialist), medical procedures (C-Section deliveries, colonoscopies and upper GI endoscopies, vaginal deliveries), Imaging (CT, mammography, MRI, ultrasound), dental services, and ACA services (office visit with screenings for diabetes, pap smear, lipid screenings, colonoscopy screening, mammogram screening). Change Healthcare’s Transparency Index measures costs and variability across these health services.

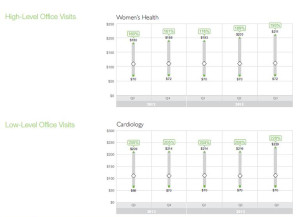

In honor of Go Red for Women to promote heart health, the first image illustrates variation in costs for office visits to cardiologists. The bottom of the two graphs shows that in the third quarter of 2013, the variation of costs for visits to cardiologists was 228%, ranging from a low of $70 to a high of $229. This is a greater cost variation than a year ago, when the costs nonetheless varied by over 200%.

In honor of Go Red for Women to promote heart health, the first image illustrates variation in costs for office visits to cardiologists. The bottom of the two graphs shows that in the third quarter of 2013, the variation of costs for visits to cardiologists was 228%, ranging from a low of $70 to a high of $229. This is a greater cost variation than a year ago, when the costs nonetheless varied by over 200%.

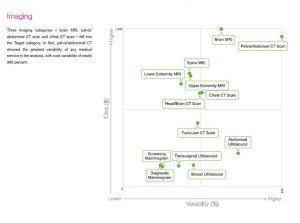

Compared to other health services, though, this cost variance is relatively small vis-a-vis, say, CT scans with a cost variability of 794% (from $300 to a stunningly high $2,781) and ultrasounds, varying 472% (from $100 to $562).

The second graph summarizes variations in imaging exam modalities relative to their cost. The takeaway here is that mammograms, transvaginal and breast ultrasounds have relatively low cost and low variability, and brain and spine MRI, and pelvic/abdominal CT scans have high cost and high variability.

Change Healthcare identified eight specific opportunities for greater transparency efforts that could move the needle downward on costs.

These include:

- CT scans

- Colonoscopies

- Mammograms

- MRI scans

- Ultrasounds

- C-Section deliveries

- Office visits with lipid screening

- Office visits with diabetes screening.

Furthermore, it’s not just the type of service to consider when targeting cost, but the location of the service. For example, a hospital-based MRI may price higher than an MRI at a freestanding imaging center. A physician-based ultrasound may be cheaper than one performed in a medical center’s imaging unit.

There are a growing number of trustworthy sources for consumers to access to help them compared prices. These tend to be locally focused, many of which are still incomplete. For more on this expanding market trend, see Help Yourself: The Rise of Online Health Marketplaces published by California HealthCare Foundation.

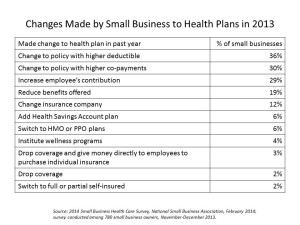

Health Populi’s Hot Points: Transparency of heath prices is increasingly crucial for American health consumers to source as people face growing deductibles and out-of-pocket health care costs. The latest report from the National Small Business Association, published earlier this week, finds that in 2013, one-third of smaller employers will be moving to higher-deductible policies, and also changing to policies with higher co-payments for workers. In addition, 29% of small businesses will be increasing employees’ contributions to health benefits. 1 in 5 employers will reduce their benefits offered.

Health Populi’s Hot Points: Transparency of heath prices is increasingly crucial for American health consumers to source as people face growing deductibles and out-of-pocket health care costs. The latest report from the National Small Business Association, published earlier this week, finds that in 2013, one-third of smaller employers will be moving to higher-deductible policies, and also changing to policies with higher co-payments for workers. In addition, 29% of small businesses will be increasing employees’ contributions to health benefits. 1 in 5 employers will reduce their benefits offered.

Going forward into 2014, more of these changes that will put greater financial responsibility on employees are afoot. 42% of small companies plan to increase employees’ contributions to health insurance, another 34% will switch to high-deductible plans, and 32% will change to policies with greater co-payments.

Why will this be the case? One in four small businesses reported health insurance cost growth of over 20% at their most recent renewal. The dollars spent on health care have a huge impact on small business. In this study, businesses estimated that monthly per-employee cost of health insurance premiums for the average family were $2,084.67, for an annual sum of over $25,000. For a single individual, that annual cost was estimated at $13,452.

One-third of small business said they are putting off hiring a new employee as a direct result of rising health insurance costs.

The link between health and wealth works on several levels: between business owners and buying health insurance; for people co-paying for health plans and their household budgets; and, for the nation’s macroeconomy, for which health cost increases continue to be the long-term lag on the deficit – a health risk factor for America’s financial wellness.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a