During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.”

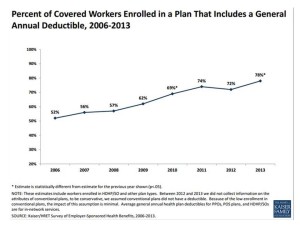

My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible.

That’s the “self-insurance” part of the observation my astute conversationalist noted.

Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for paying that first dollar of coverage up to the limit of the deductible. He noted that, as his deductible is $8,000, he has never met the deductible amount. Thus, he feels self-insured, responsible for 100% of his health care costs. That’s his financial health-wealth reality.

Of course, it is good news that he is not sick, so he’s not running up health expenses above $8,000. At that point, his health plan would kick in spending based on the terms in his contract over-and-above the 8 grand.

In KFF’s report on Medical Debt Among People with Health Insurance published in January 2014, the Foundation learned that 1 in 3 Americans has trouble paying medical bills – they are gradually paying them off if they can, or they have bills they can’t afford to pay at all. Note to reader: read carefully. These are people with health insurance.

KFF found that medical debt impacts “everybody,” from families with incomes at $10,000 as well as those exceeding $100,000 a year.

The money quote, if you will: “Among insured individuals, unaffordable medical debts resulted primarily from cost-sharing for care covered by their insurance.” In addition, cost problems happen with out-of-network charges, coverage limits and exclusions form policies, unaffordable premiums, and related problems like the irony of getting sick and having to leave work for a period of time — thus, not generating income to pay the insurance premium or health care visits.

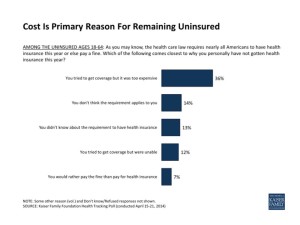

Health Populi’s Hot Points: In America, if paying for health care when you have insurance is difficult, then it may be obvious but must be said: cost is the primary reason people choose to remain uninsured. The second graph shows this finding from KFF’s April 2014 Health Tracking Poll. One-half of these people expect to pay a fine for staying uninsured, although 15% of these people don’t know what that fine will cost them.

Health Populi’s Hot Points: In America, if paying for health care when you have insurance is difficult, then it may be obvious but must be said: cost is the primary reason people choose to remain uninsured. The second graph shows this finding from KFF’s April 2014 Health Tracking Poll. One-half of these people expect to pay a fine for staying uninsured, although 15% of these people don’t know what that fine will cost them.

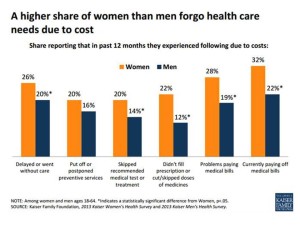

More self-rationing has resulted among women who report delaying care in the past year due to costs, found in KFF’s 2013 Women’s Health Survey and discussed in the report, Women and Health Care in the Early Years of the Affordable Care Act.

has resulted among women who report delaying care in the past year due to costs, found in KFF’s 2013 Women’s Health Survey and discussed in the report, Women and Health Care in the Early Years of the Affordable Care Act.

We’ve covered this issue of women’s health costs and self-rationing since KFF tracking poll noted it back in 2008, here.

More women face cost-related barriers to care, and they make tough trade-offs – using up savings, foregoing basic necessities, or borrowing money from friends to pay their medical bills. In addition, logistical barriers — like not being able to take off work to seek health care or transportation problems in getting to their doctor’s office – often prevent women from getting needed care. These are non-financial costs that are, nonetheless, direct costs to the consumer that translate into personal health economics at some point — either taking time off from a job to see the doctor, or paying a high price for a taxi to get there. Ultimately, medical bills affect many women’s financial stability.

More women face cost-related barriers to care, and they make tough trade-offs – using up savings, foregoing basic necessities, or borrowing money from friends to pay their medical bills. In addition, logistical barriers — like not being able to take off work to seek health care or transportation problems in getting to their doctor’s office – often prevent women from getting needed care. These are non-financial costs that are, nonetheless, direct costs to the consumer that translate into personal health economics at some point — either taking time off from a job to see the doctor, or paying a high price for a taxi to get there. Ultimately, medical bills affect many women’s financial stability.

We are all self-insured until we get sick. But some of us are able to self-insure more effectively than others, and women less so than men.

It’s National Women’s Health Week. Let’s work to close health disparities across all the chasms.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a