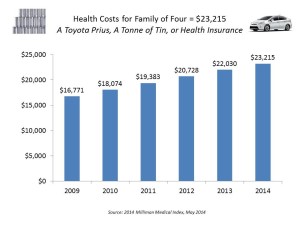

It costs $23,215 to cover a family of four for health care, according to the 2014 Milliman Medical Index (MMI), the annual gauge of healthcare costs from the actuarial firm.

It costs $23,215 to cover a family of four for health care, according to the 2014 Milliman Medical Index (MMI), the annual gauge of healthcare costs from the actuarial firm.

The growth rate of 5.4% from 2013 is the lowest annual change since Milliman launched the Index in 2002. This is equivalent to a new Toyota Prius or a tonne of tin.

While employers cover most of these costs, the portion employees bear continues to increase. This year, insured workers will take on 42% of the total, or on average, $9,695. This is up by $552 over 2013, or 6% more in 2014. Employers’ increase in 2014 is 4.9% over 2013. In the words of Milliman, “while both employer and employee costs increased, the employee experienced a larger percentage increase.”

Although Milliman calculates that the rate of increase in health plan costs was the lowest in 12 years at 5.4%, note that the consumer price index (CPI) grew 2.0% in the past year (per the BLS report, May 2013-April 2014).

There are five factors to watch, Milliman advises, that could change the dynamics of health costs in the next year: transparency of costs (which could pressure them downward if purchasing becomes more transparent, driving greater consumerism); the rate of economic growth; supply and demand influences, such as Medicaid growth and insurers’ price negotiations in local markets; health providers better controlling costs; and specialty pharmacy prices driving costs up (see the Hep C Solvadi story as an example).

Health Populi’s Hot Points: Health-insured workers are bearing greater financial risk for health costs. This risk-shift is part of the Brave New World of consumer-driven health care – which isn’t exactly new, but the bigger risks (in the form of higher-and-higher deductibles) are.

Health Populi’s post on 19 May was titled “We are all self-insured now.” The Milliman Medical Index for 2014 reinforces that theme. As families take on more health costs, they’ll be trading off other spending on household goods and services. U.S. consumer spending on health care jumped to a record 17.1% in February 2014.

Chris Low of FTN Financial in New York observed that consumer spending on medical services grew 4.1% between October 2013 (when the Health Insurance Exchanges launched) and February 2014 00 the largest five-month increase since July 1992, he assessed. As a result, he warned his clients in a March note, “The effect on consumption is already so substantial, we ignore it at our own peril.” Low expects a slow-down in retail sales serving mainstream consumers, like Target and Walmart.

We’re not only all self-insured now. We’re working for the national health care economy as wages have remained fairly flat over the past decade, and consumer spending on health care has grown.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're