Consumers around the world are feeling more knowledgeable, self-confident and realistic, enabled by mobile platforms, the democratic power of social “choruses,” and a more sharing economy featuring collaborative consumption.

Consumers around the world are feeling more knowledgeable, self-confident and realistic, enabled by mobile platforms, the democratic power of social “choruses,” and a more sharing economy featuring collaborative consumption.

As peoples’ phones get smarter and smarter, they carry more powerful multichannel information devices in their hands which empower Homo Informaticus – the new global digital consumer, described in EY’s report, How to copilot the multichannel journal. EY polled 29,943 consumers in the Consumers on Board survey living in 34 countries: across the Americas, Asia-Pacific, the Middle East, India and Africa.

Homo informaticus is the rational consumer smartly using technology to filter information. While people are keen for personalization, there are still commonalities across digital consumers.

EY found that, globally, consumers are smarter, more cautious, connected – researching and considering before they buy, considering price (across all categories), value and quality, and support (say, for after-purchase warranties and call center access).

Ten consumer products and service categories were considered:

- Telephone/mobile

- Consumer loans

- Household insurance

- Food and beverages

- Consumer electronics

- Cars

- Clothes

- Commodities

- Health care

- Health insurance (new category in the 2014 survey).

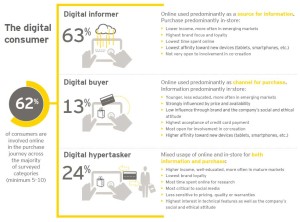

Two-thirds of digital consumers purchase stuff online for at least five in ten categories, illustrated in the infographic. Two-thirds of those digital shoppers get digitally informed, comparing products online but usually purchasing in-store. 13% are primarily digital buyers, and 24% of digital folk are “hypertaskers,” which EY defines as mixing use of online and in-store for both informing/shopping and buying. Hypertaskers are the fastest-growing segment of digital consumers. They’re most informed, and they are the shoppers of the future, EY expects.

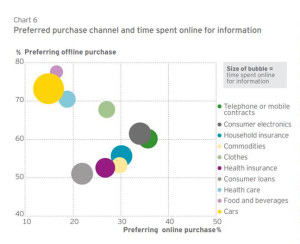

A shift to online sh opping overall has resulted in a decline of brick-store shopping for most categories. Products still mostly purchase in-store include food and beverages, clothes, and health care. Products most often purchased online were consumer electronics, clothes, phone and mobile contracts, commodities, and health insurance.

opping overall has resulted in a decline of brick-store shopping for most categories. Products still mostly purchase in-store include food and beverages, clothes, and health care. Products most often purchased online were consumer electronics, clothes, phone and mobile contracts, commodities, and health insurance.

Health Populi’s Hot Points: The EY survey yields important findings for health, wellness and health care. It’s clear that consumers prefer offline purchasing for cars, food and beverages, and health care. Online channels are preferred more for consumer loans, commodity products, consumer electronics, phone contracts, household insurance and health insurance.

The sizes of the bubbles represent time spent online seeking information: note that consumer spend a lot more time shopping for cars than for either health care or health insurance. This phenomenon was confirmed in a 2012 HealthGrades consumer survey.

One key finding that’s especially relevant for health consumers is the emergence of personal data as a consumer asset. While consumers expect personalized service from the organizations with which they interact, people increasingly know that their personal data has value that enables companies to generate income. Consumers are growing more selective sharing data: 49% of consumers in an EY survey on big data said they’d be less likely to share personal data by 2018. EY points out that the pharmaceutical sector will be challenged by this in the future, and I forecast this will be a challenge for all stakeholders involved in the health ecosystem. People will want to be rewarded and respected — especially as health consumers and citizen scientists who share data.

For more on consumer-generated data, health and privacy, see my paper Here’s Looking at You: How Personal Health Information Is Getting Tracked and Used, published July 15, 2014 by the California HealthCare Foundation on July 15, 2014 (link to follow in mid-July 2014).

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for