The one aspect of American health care that unites consumers and providers alike is cost, which is driving high anxiety among both providers and patients. Most of them also agree that the American health care system is on the wrong track.

For patients, the anxiety is about ability to pay for and access the health care service to which they’ve become accustomed. For providers (and especially those over 55 years of age), the anxiety about costs is doctors’ and hospitals’ ability to survive in the uncertain health-economic environment.

The survey report, How We View Health Care in America, marks the first of what Strategy& (formerly Booz and Company) and Ipsos Public Affairs plan as an annual study into U.S. health consumers’ and providers’ perspectives. This year’s poll will serve as a baseline for comparing future studies.

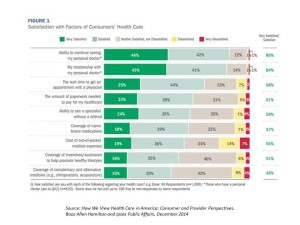

Most U.S. health consumers are satisfied with their relationship with their personal doctors, wait times to get an appointment to see the doctor, and their ability to see a specialist without a referral, shown in the first chart. However, when it comes to cost for services and coverage of complementary and alternative medicine services, fewer consumers are satisfied. Levels of satisfaction vary by demographics and issue: younger people are generally less satisfied across all of the consumer satisfaction items polled, and older people are more satisfied. People with lower incomes (under $50K) tend to be less satisfied, as well. Women tend to be less satisfied than men across-the-board, with the exception of the wait times to see a physician.

The biggest satisfaction gap for consumers is the importance of health care costs and their level of (low) satisfaction about those costs. Those most satisfied about their personal health care costs are covered by Medicare (86% satisfied with their costs), followed by those covered under Medicare (78%) and Group Plans (71%). Fewer people who are covered by insurance via individual or exchange-purchased plans are satisfied with costs (55%), as well as those without insurance coverage (22%).

Patients and providers are also on the same page when it comes to “who” to blame for rising health care costs: first and foremost, health insurance and pharmaceutical companies.

But there’s a technology gap when it comes to how consumers use apps and phones versus providers’ use of tech. Most consumers who use tech for health do so for general health reference look-up, exercise monitoring, and checking health insurance coverage or claims, nutrition, weight loss and counting calories, and e-refills. 4 in 10 consumers said a health providers recommended apps to them.

a technology gap when it comes to how consumers use apps and phones versus providers’ use of tech. Most consumers who use tech for health do so for general health reference look-up, exercise monitoring, and checking health insurance coverage or claims, nutrition, weight loss and counting calories, and e-refills. 4 in 10 consumers said a health providers recommended apps to them.

Physicians are most likely to recommend apps to patients for appointment scheduling, accessing electronic health records, and secure messaging — none of which is on consumers’ top-ranked health-tech list.

While most health care providers see web-based digital health and mobile apps as constructive tools for health management, 9 in 10 say they must be vetted for accuracy and ease of understanding for their patients. Most clinicians also say that mHealth technologies in practice have a “long way to go” to prove their value in bolstering health outcomes.

The survey interviewed 1,000 online adults 19 and over in August 2014. The researchers also polled 400 health care providers in August 2014 to complement consumers’ responses to the survey.

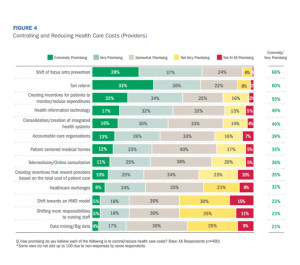

Health Populi’s Hot Points: Because health care costs ranked high on both providers’ and consumers’ minds, it’s important to note what tactics providers perceive have the most promise to control and reduce costs. Most providers point to prevention, tort reform, incentives for patients to reduce spending, and health information technology (HIT) as the most promising approaches for saving costs in U.S. health care, as the second table attests.

Telemedicine, however, is quite low on the list of providers’ potential cost-reduction strategies, as is “creating incentives that reward providers based on the total cost of patient care.” Ironically, the former is useful if the latter is in place: that is, when there is accountable or value-based payment in place to health care providers, they would have an incentive to seek lower-cost (quality) settings for care that provide the patient access and convenience. Now that Medicare has begun to pay for virtual patient visits, the financial viability of doing remote care makes more (fiscal) sense for physicians (for more on the new CPT-code for telemedicine, see my 2015 Health IT Forecast in iHealthBeat here).

Telemedicine, however, is quite low on the list of providers’ potential cost-reduction strategies, as is “creating incentives that reward providers based on the total cost of patient care.” Ironically, the former is useful if the latter is in place: that is, when there is accountable or value-based payment in place to health care providers, they would have an incentive to seek lower-cost (quality) settings for care that provide the patient access and convenience. Now that Medicare has begun to pay for virtual patient visits, the financial viability of doing remote care makes more (fiscal) sense for physicians (for more on the new CPT-code for telemedicine, see my 2015 Health IT Forecast in iHealthBeat here).

Physicians, however, are keen on putting financial incentives on patients to reduce health care spending. Rising out-of-pocket costs and high deductible health plans are already driving consumers toward using mobile and digital technologies for health in the ways that fit into their life-flow….as well as curbing their use of health care services when seen as unnecessary or costly. Be forewarned, providers and health care administrators: more consumers will self-ration traditional health care services in offices and hospitals for more attractive, convenient, and lower-cost retail health settings (urgent care clinics, pharmacies, grocery stores, worksite clinics and, yes, telemedicine to the home via MDLive, American Well, et. al.) when they can if you don’t heed the pain points of your users: that is, patients, well consumers, and caregivers.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for