“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news.

“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news.

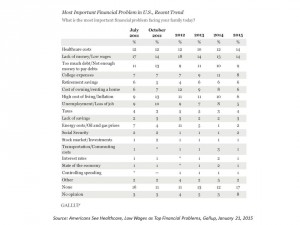

But from the point-of-view of consumers’ own pockets, health care costs are rising. And, a survey published today by Gallup points to this reality: that people in American say the most important financial problem they face is healthcare costs, tied for first place with lack of money and low wages.

Workers’ wages have stayed relatively flat for many years, shown in the second chart, which also illustrates the hockey-stick growth of health plan premium costs. Health costs have risen, year on year, faster than general inflation and wage growth. Consumers know this, feel this, and called this out to Gallup. What the chart shows, and what consumers get, is that they’ve traded off wage increases for health benefits.

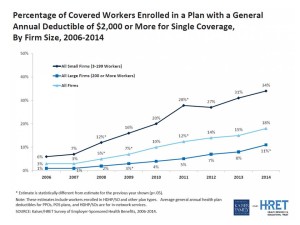

Employers, looking to manage their portion of the health care cost burden, are migrating health insurance to high-deductible health plans – so-called “consumer-directed health plans” (CDHPs). Where health plan enrollees were financially exposed to co-payments and coinsurance for health services and products under traditional health plans or discounted fee-for-service insurance, CDHPs expose newly-minted health care “consumers” to first-dollar coverage — in the magnitude of $1,000 or more — fiscally flowing straight out-of-pocket until the deductible is met.

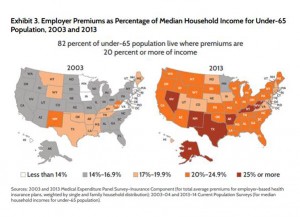

The two U.S. maps tell the underlying macroeconomic story, published in The Commonwealth Fund Biennial Health Insurance Survey, issued in November 2014. Throughout the U.S., out-of-pocket costs for premiums and cost-sharing have increased, the Fund reports. On average, they calculate premiums for a family of four in 2013 were $16,029. By 2013, annual premiums equated to 20% or more of median income in all but 13 states and DC. Health premiums comprised at least 25% of income in seven states (Alaska, Arkansas, Kentucky, Nevada, New Mexico, Texas, and West Virginia). The bottom line: 82% of people under 65 in the U.S. lived in states where health premiums were at least 20% of median incomes in 2013.

The two U.S. maps tell the underlying macroeconomic story, published in The Commonwealth Fund Biennial Health Insurance Survey, issued in November 2014. Throughout the U.S., out-of-pocket costs for premiums and cost-sharing have increased, the Fund reports. On average, they calculate premiums for a family of four in 2013 were $16,029. By 2013, annual premiums equated to 20% or more of median income in all but 13 states and DC. Health premiums comprised at least 25% of income in seven states (Alaska, Arkansas, Kentucky, Nevada, New Mexico, Texas, and West Virginia). The bottom line: 82% of people under 65 in the U.S. lived in states where health premiums were at least 20% of median incomes in 2013.

The Gallup study shows that American health consumers are acutely feeling that financial skin-in-the-game for health care.

Health Populi’s Hot Points: In the Wall Street Journal analysis of the #SOTU15, the key themes by mention of keywords were Jobs (19 times), Economy (18 mentions), Congress (13), College (12), Childcare (8), Terrorist (7), Middle class (7), Change (6), Leadership (6), Diplomacy (6), with all other themes spoken 5 times or fewer (including Opportunity, Cuba, Climate, Bipartisan, War, Afghanistan, Tax code, ISIL, Immigration, and Transgender).

The keyword “healthcare” didn’t come up in WSJ’s analysis, although I recall hearing it during the speech. President Obama explicitly said, “We can’t put the security of families at risk by taking away their health insurance, or unraveling the new rules on Wall Street, or re-fighting past battles on immigration when we’ve got a system to fix….And if a bill comes to my desk that tries to do any of these things, it will earn my veto.”

Even with the continued expansion of the Affordable Care Act and U.S. health citizens’ buy-in for health insurance, they’ll continue to feel health costs impinging on other household budget line items like food, housing, and clothing. The impact of consumers’ personal “gas price surplus” (lower petrol prices at the pump) has bolstered peoples’ positive consumer sentiment, giving rise to greater household spending in the short term. But the wild card for sustaining American economic optimism will be larger macroeconomic expansion — and the middle class feeling the benefit of it at the kitchen table and medical spending.

Thank you FeedSpot for

Thank you FeedSpot for