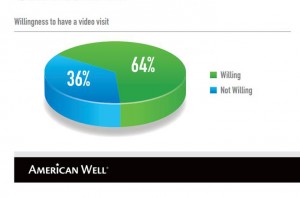

Evide nce of the rise of retail health grows, with the data point that on-demand health care is in-demand by 2 in 3 U.S. adults. American Well released the Telehealth Index: 2015 Consumer Survey, revealing an American health public keen on video visits with doctors as a viable alternative to visiting the emergency room. Virtual visits are especially attractive to people who have children living at home.

nce of the rise of retail health grows, with the data point that on-demand health care is in-demand by 2 in 3 U.S. adults. American Well released the Telehealth Index: 2015 Consumer Survey, revealing an American health public keen on video visits with doctors as a viable alternative to visiting the emergency room. Virtual visits are especially attractive to people who have children living at home.

[For context, this survey defines “telehealth” as a remote consultation between doctor and patient].

Convenience drives most peoples’ interest in telehealth: saving time and money, not leaving home if feeling unwell, and “avoiding germs lurking in hospitals and clinics,” AmWell’s report describes.

Still, in the middle-of-the-night, twice as many people would pick an ER (44%) over a video visit (21%), the survey found, followed by phoning a 24-hour nurse line for advice via telephone (17%).

The growth of online physician-patient chat boards is evident with companies like HealthTap receiving an influx of $24 mm and MedHelp’s acquisition by Physicians Interactive in the past 18 months, so it’s informative that AmWell’s survey asked consumers where they perceived they could find the best diagnostic results by virtual visit channel: high-definition video, telephone, or email? Two-thirds of consumers with believed HD Video outranked phoned (30%) o r email (7%).

r email (7%).

Even with the consumer exuberance for willingness to have a video visit with a doctor, currently, only 7% of people would be willing to change doctors based on the availability of online visits, shown in the second (blue) chart. Underneath that number, willingness to switch to a doctor offering online visits is directly correlated to age: younger patients (presumably with looser ties to a primary care practitioner, PCP) tend to favor telehealth overall: “interest in telehealth peaks in ages 18-44,” AmWell found.

To bolster the company’s reach to consumers, AmWell recently released a mobile app that enables users to access a mobile medical visit. In a press release, the company called it “the most popular telehealth app of 2014.” MDLIVE also expanded its consumer engagement channel, partnering with Walgreens in December 2014.

The survey was conducted among 2,019 consumers in December 2014.

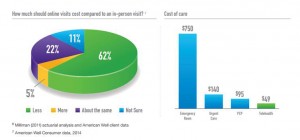

Health Populi’s Hot Points: What’s behind consumers’ interest in accessing telehealth is convenience. And cost will play a growing role in health consumers choosing between (more expensive) ERs and less expensive retail clinics and virtual visits via smartphones, tablets and PCs. The third chart shows consumers’ bias that virtual visits should cost less than in-person visits to doctors. In real life, this bears out, with the average ER visit running $750 compared with $140 for urgent care, $95 for a PCP, and $49 for telehealth (via AmWell). “Increasing access to care without breaking the bank is one of the core tenants <sic – should read “tenets”> of telehealth services.”

All payors — consumers, employers, and plan sponsors like Medicare — are expanding interest in telehealth as a lower-cost, appropriate technology option for care. CMS identified a CPT-code in 2014 for virtual visits (with a fairly strict definition). Governor Cuomo in New York state is a fan of telehealth, signing a telehelath bill into law this month. A bipartisan bill introduced to the Colorado legislature this month also promotes the use of telehealth.

Commercial insurance plans have begun to cover for video-based visits. Employers continue to push for care delivered in the lowest-cost settings for the right worker at the right time. The category is expanding for mental health which has been under-supplied in many geographic regions and for certain demographics (covered here in my paper, The Online Couch: Mental Healthcare on the Web, for California HealthCare Foundation. On January 1, 2015, Medicare began to reimburse for virtual psychotherapy services under CPT codes 90845, 90846, and 90847.

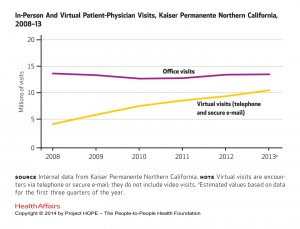

What’s prevented the mass adoption of telehealth has been reimbursement: following money in a volume-based payment world has prevented the innovation from going mainstream. Look at Kaiser-Permanente, an early-adopter of telehealth. No wonder: as an integrated delivery system and payor, the organization has had natural incentives to adopt electronic health records, promote patient self-care through use of a personal health record, promote healthy eating through farmers’ markets and nudge patients to virtual visits. The fourth chart illustrates KP’s growing use of virtual visits as in-person office visits have remained relatively flat over the past six years.

What’s prevented the mass adoption of telehealth has been reimbursement: following money in a volume-based payment world has prevented the innovation from going mainstream. Look at Kaiser-Permanente, an early-adopter of telehealth. No wonder: as an integrated delivery system and payor, the organization has had natural incentives to adopt electronic health records, promote patient self-care through use of a personal health record, promote healthy eating through farmers’ markets and nudge patients to virtual visits. The fourth chart illustrates KP’s growing use of virtual visits as in-person office visits have remained relatively flat over the past six years.

A value-based payment world, coupled with consumers bearing more health care costs, are enablers for telehealth adoption. Virtual visits will become mainstream as all payers, and especially consumers, push for greater convenience (driven by out-of-pocket spending and greater DIY health care). Expect this as part of the blurring lines of retail health.

But not everybody is happy about the growth of telehealth. Family practitioners warn, in the 1st February 2015 issue of the AAP News (article behind a pay-wall), that “Direct-to-consumer telehealth care threatens (the) medical home.” AAP News is the news magazine for pediatricians, who can see from the American Well survey results that people with kids at-home are even keener on telehealth than folks with no children. But it’s those sore throats on Sundays and raging fevers at midnight that challenge parents – health consumers on behalf of their children. So people (and particular those 25-44) will seek out accessible, available, cost-effective quality care when they want and need it. Pediatricians looking to be relevant to their patients’ parents will find a way to deal with the telehealth while preserving their relationships with young patients. Those doctors who don’t may lose patients to that blurring supply side of retail health care services.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a