Offering wellness programs is universal among U.S. employers, who roughly divide in half regarding their rationale for doing so: about one-half offer wellness initiatives to invest in and increase worker health engagement, and one-half to control or reduce health care costs. Two-thirds of companies offering wellness will increase their budgets, according to the International Foundation of Employee Benefit Plans (IFEBP) report, Workplace Wellness Trends, 2015 survey results.

Offering wellness programs is universal among U.S. employers, who roughly divide in half regarding their rationale for doing so: about one-half offer wellness initiatives to invest in and increase worker health engagement, and one-half to control or reduce health care costs. Two-thirds of companies offering wellness will increase their budgets, according to the International Foundation of Employee Benefit Plans (IFEBP) report, Workplace Wellness Trends, 2015 survey results.

The IFEBP polled 479 employers in October 2014, covering corporate, public, and multi-employer funds in the U.S. and Canada. The statistics discussed in this post refer solely to U.S. organizations included in the study (372 of the total sample).

The breadth and depth of wellness programs are expanding. The most mature category is screening and treatment, which includes flu shots, health risk appraisals (HRAs), and health screening, along with newer services like smoking-cessation, smoke-free worksite policies, disease management and on-site clinics and massage therapy. Relative to disease management, it’s interesting to note the top conditions employers point to impacting health plan costs: diabetes (47% of all employers), heart disease (41%), cancer (36%), arthritis/back/musculoskeletal (36%), obesity (28%), hypertension and high blood pressure (28%), high cholesterol (18%), and depression/mental illness (14%).

Fitness and nutrition initiatives are offered by about one-half of employers, with wellness competitions (such as walking challenges), health coaching, healthy food choices in cafeterias and vending machines, and weight-loss management programs at the top of the list. On-site exercise/yoga classes are offered by 1 in 4 employers, and on-site fitness centers by 1 in 3 companies.

A relatively new segment of wellness is social and community health initiatives, which were once led by blood drives at the workplace. Today, community charity drives (think: food drives, school supply collections) rank at the top of this wellness effort.

Mental health initiatives make up the fourth category, where employee assistance programs (EAPs) continue to lead the pack (80% of U.S. companies), followed by mental health first aid training (for 69%), critical incident and crisis response counseling (in 33%), Some 11% of employers offer end-of-life counseling, which THINK-Health forecasts as a fast-growing area for employee health benefits.

Wellness incentives are offered by about one-half of companies, with health literacy education close behind. Significantly, wellness-related technology and/or gamification is offered by 35% of U.S. companies – a new-new area in wellness and health benefits. Financial education is also growing in emphasis for employee wellness, offered by 32% of employers in the next two years.

Carrots are more frequently offered than sticks by a factor of 2 (28% provide insurance premium reductions versus 14% levying penalties).

1 in 5 employers is offering a personal health record to employees, and 16% providing access to social media/networks for wellness.

Health Populi’s Hot Points: That 35% of U.S. employers will offer wellness-related technology (inc. gamification) in the next two years to underpin the company’s workplace wellness strategy is an inflection point in the adoption of health/fitness tech, driven by payors — that is, the worker’s health insurance plan sponsor. The forms that these technology/gamification programs will take include:

Health Populi’s Hot Points: That 35% of U.S. employers will offer wellness-related technology (inc. gamification) in the next two years to underpin the company’s workplace wellness strategy is an inflection point in the adoption of health/fitness tech, driven by payors — that is, the worker’s health insurance plan sponsor. The forms that these technology/gamification programs will take include:

- Apps to be used in programs and initiatives, for 29% of employers

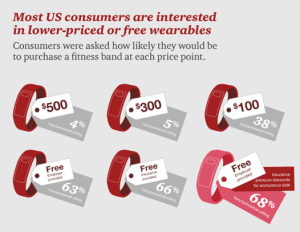

- Free or discounted wearable tracking devices (e.g., Fitbits, named as an example in the survey), for 29%

- Gamification in programs, for 16%

- Spreadsheets for workers to track wellness participation, 14%.

I point you to the finding, discussed here in Health Populi, that consumers will more likely adopt personal health tech if the device is cheap, or better yet, free.

In the adoption curve for digital consumer health and fitness technology, employers and their generous wellness programs will play a key role in nudging adoption, and ongoing use, of these devices, a forecast point supported by IFEBP’s research.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a