While there’s little evidence that the short-term impact of the Affordable Care Act has limited job growth or driven most employers to drop health insurance plans, the ACA has spawned a “cottage industry” of health companies since 2010, according to PwC.

While there’s little evidence that the short-term impact of the Affordable Care Act has limited job growth or driven most employers to drop health insurance plans, the ACA has spawned a “cottage industry” of health companies since 2010, according to PwC.

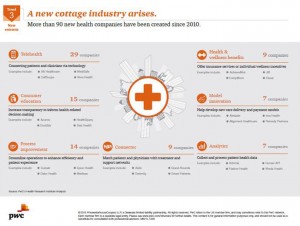

As the ACA turned five years of age, the PwC Health Research Institute led by Ceci Connolly identified at least 90 newcos addressing opportunities inspired by the ACA:

- Supporting telehealth platforms between patients and providers, such as Vivre Health

- Educating consumers, such as the transparency provider HealthSparq does

- Streamlining operations to enhance efficiency, the business of Cureate among others

- Connecting patients and physicians, like SmartPatients and Doximity do

- Offering health and wellness benefits that complement health plans on the marketplaces, like the novel health plan Oscar does

- Developing new payment and care delivery models, including Iora Health

- Performing big data analytics, such as Human API does.

The five key trends PwC notes are the changing nature of risk, primary care, new entrants, health insurance, and States continuing to be the labs of experimentation.

Health Populi’s Hot Points: These new business concepts are largely based on two key macro-trends that are translating across health care markets in the U.S.: the migration of health care payment from volume to value, and the financial risk-shift to consumers who are paying more out-of-pocket in the forms of deductibles (and the first-dollar costs to meet that fiscal end-point when health insurance kicks in payment) and premium contributions for the plan.

Health Populi’s Hot Points: These new business concepts are largely based on two key macro-trends that are translating across health care markets in the U.S.: the migration of health care payment from volume to value, and the financial risk-shift to consumers who are paying more out-of-pocket in the forms of deductibles (and the first-dollar costs to meet that fiscal end-point when health insurance kicks in payment) and premium contributions for the plan.

As consumers take on more financial risk in health care, they look to lower cost entry points – what we’ve described as on-ramps to health services (a la “Health Care Automats”), which new enrollees in health care really need to be able to navigate the labyrinthine U.S. health system; and which savvier more mature users of health plans know can help save cost and provide convenient channels to primary care and other health services where people live, work, play and learn.

Welltok and Oliver Wyman’s work on health care incumbents vs. consumers describes those on-ramps as “the new front door,” phenomena which we’ve described here on Health Populi and on HealthcareDIY.

Will the newcos, the likes of which are highlighted in the PwC report, nudge out the incumbents — hospitals, physicians, Big Pharma, the big-iron medical device industry, and health plans that don’t raise their consumer-facing game?

Here’s a hint about how incumbents must raise their game to stay relevant to consumers: the Temkin Group’s 2015 Experience Ratings were released this week, gauging U.S. consumers’ perceptions of individual companies customer service excellence. The third chart shows that health plans rank low, with rental car agencies, TV and Internet services providers, on the consumers’ customer service rankings. But check out the bars to the north of the graph: supermarkets, food chains, retailers and banks rank much more highly in the minds of consumers. And these retail channels are increasingly providing new on-ramps to consumers.

Here’s a hint about how incumbents must raise their game to stay relevant to consumers: the Temkin Group’s 2015 Experience Ratings were released this week, gauging U.S. consumers’ perceptions of individual companies customer service excellence. The third chart shows that health plans rank low, with rental car agencies, TV and Internet services providers, on the consumers’ customer service rankings. But check out the bars to the north of the graph: supermarkets, food chains, retailers and banks rank much more highly in the minds of consumers. And these retail channels are increasingly providing new on-ramps to consumers.

This emphasizes our continued counsel to the legacy health ecosystem stakeholders, providers, plans, and suppliers to the industry alike: think like a retail, consumer-facing marketer. Know Thy Consumer.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a