As much as the Affordable Care Act is bolstering health insurance rolls for the uninsured, people who have enjoyed health insurance at work continue to highly value that benefit, according to a survey from Benz Communications and Quantum Workplace published April 2015.

As much as the Affordable Care Act is bolstering health insurance rolls for the uninsured, people who have enjoyed health insurance at work continue to highly value that benefit, according to a survey from Benz Communications and Quantum Workplace published April 2015.

Based on a national sample of over 2,000 employees surveyed in October 2014 about workplace benefits. The research re-confirms the long-term reality of workers working in America for the health benefit.

Benz/Quantum note that 89% of workers say health benefits play a part in remaining on-the-job, and half say the health benefit is a “major” part of remaining in a job. If a prospective employer doesn’t offer health insurance, 3 in 4 people say they wouldn’t work for that company.

Add to this perception of health insurance job-lock the finding that one-half of workers say they ask doctors how much their care will cost…leaving 50% of workers avoiding the healthcare cost discussion. This conversation varies by income, with more lower-income workers (58% of those earning under $25K a year) inquiring into health care prices compared to 35% of people making over $200K per year asking clinicians about health costs.

Health Populi’s Hot Points: Consider the covered worker’s new brandbrea of health plan design: the high-deductible health plan. This study raises an important challenge for the health plan member with an HDHP: to use that health plan in a financially rational fashion, the worker must know, in advance, what care will cost. Most people, though, aren’t effective health care shoppers yet. Price transparency, options for services in a local market, and the nature of those services (quality, reputation and credentials of providers, and even the price of parking if that’s part of the customer-patient experience) aren’t available to most health-insured workers. The poorest of the poor must know about prices as they tightly manage low wages that must balance the price of a loaf of bread against the cost of a lab test.

So the challenge is how quickly health care services can morph into true retail-looking-and-feeling services, like dry cleaners who post the cost of various options.

So the challenge is how quickly health care services can morph into true retail-looking-and-feeling services, like dry cleaners who post the cost of various options.

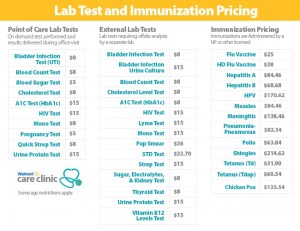

There is a model for this, and it’s the retail clinic which posts the prices for vaccinations, school year check-ups, and health checks for, say, a sore throat.

The second chart illustrates such a list. It’s from the Walmart Primary Care Clinic’s price list for lab tests and immunizations. This is what retail health looks like, and it’s what fits into peoples’ everyday lives. It’s clear, understandable, accessible.

I believe this is what is referred to as “communication.” And in this case, that communication is about value-for-money which, in the highly price-sensitive high-deductible-health-plan world, is the health consumer’s Job 1.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a