The number of people in the U.S. spending over $100,000 a year on prescription drugs tripled in 2014, according to Super Spending: U.S. Trends in High-Cost Medication Use, from The Express Scripts Lab.

The number of people in the U.S. spending over $100,000 a year on prescription drugs tripled in 2014, according to Super Spending: U.S. Trends in High-Cost Medication Use, from The Express Scripts Lab.

Express Scripts is a pharmacy benefits management company that manages over one billion prescriptions a year. The company analyzed prescription drug claims for 31.5 million health plan members for this study, in commercially insured, Medicare, and Medicaid plans.

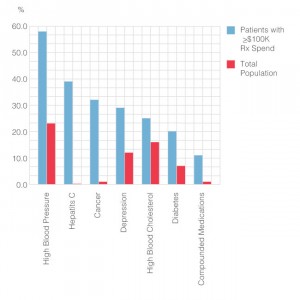

The big-dollar story in 2014 was Hepatitis C, with a relatively small patient population but a super-sized drug spend as the first chart shows: a very tall blue bar (Rx costs for patients exceeding $100,000 a year) and an almost imperceptible red bar (patient population). Compare this with the #1 drug spend for high blood pressure, or high cholesterol, with big spends and big populations.

An important part of the spending story involves depression, which is quite often a co-morbidity with other diagnoses. Nearly 1 in 3 patients had at least one prescription for an antidepressant among patients with annual drug spending over $50,000. And, 2x as many patients taking a high-cost specialty medication also had at least one prescription for an antidepressant versus the overall patient population. Anti-depressant use was found quite likely among people with diabetes, cancer, Hep C, HIV, and Multiple Sclerosis.

Treating the “whole patient” will help mitigate and rationalize wasteful and ineffective drug spending, Express Scripts believes, recommending a pharmacy providing integrated, coordinated care including specialist pharmacists, doctors, nurses, nutritionists and other professionals relevant for the particular patient — to personalize care.

Health Populi’s Hot Points: Earlier this week, Sen. Bernie Sanders (I-Vt.), who announced his candidacy to run for U.S. President in 2016, asked the Department of Veterans Affairs (the VA) to “invoke emergency powers) to make Hep C drugs available to veterans. This was prompted by the VA’s recent blockage of access to the drugs for veterans because the department had burned through the $400 mm earmarked for the drugs.

Health Populi’s Hot Points: Earlier this week, Sen. Bernie Sanders (I-Vt.), who announced his candidacy to run for U.S. President in 2016, asked the Department of Veterans Affairs (the VA) to “invoke emergency powers) to make Hep C drugs available to veterans. This was prompted by the VA’s recent blockage of access to the drugs for veterans because the department had burned through the $400 mm earmarked for the drugs.

The VA has about 20,000 patients on the Hep C drugs, but believes there are an additional 200,000 patients who have Hep C and do not have access to these specialty drugs.

Sanders is quoted on his website from a letter he wrote to the Secretary of the VA: “Our nation’s veterans cannot and should not be denied treatment while drug companies rake in billions of dollars in profits….We must not allow corporate greed to stand in the way of this potential.”

That’s the politics of the situation. About the time Sanders sent his letter to Secretary McDonald of the VA (link to PDF found on the page), this week Pharmaceutical Executive magazine named the Hepatitis C drugs Sovaldi and Harvoni . The 31-member editorial board of the magazine voted unanimously for this decision, which never happened before in the 9 years that the publication has crowned a Brand of the Year (previous products have included Copaxone (2014), Januvia (2013), Humira (2012), Gilenya (2011), Avastin (2010), Crestor (2009), Chantix (2008) and Merck’s Gardasil vaccine was the first award).

Sovaldi’s first-year sales in 2014 were $10.3 bn in the U.S., a record for the launch of any new grand name drug. (Harvoni sales were $2 bn).

Express Scripts forecasts that by 2016, spending on hepatitis C medications will exceed that of medications for high blood pressure and high cholesterol. “The explosive drug trend is led by new therapies that cost $1,000 a day, sometimes more than $100,000 per patient, and are taking a premium on already inflated treatment costs,” Express Scripts warns its key client base: employers and health plans. “These costs are unprecedented and unsustainable,” the PBM asserts.

To help those employers and health plans anticipate their Hep C costs, Express Scripts and Accredo (the company’s specialty pharmacy arm) developed an online tool, the Plan Cost and Trend Calculator, available here.

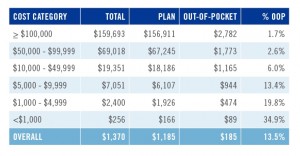

If you’re a person diagnosed with Hep C, do you pay that $1,000 a day? The second chart indicates that 0.22% of patients spent over $50,000 on Rx drugs in 2014, equal to about 576,000 people in the U.S. This group of patients represents 15.7% of total Rx costs, and 0.22% of patients.

If you’re a person diagnosed with Hep C, do you pay that $1,000 a day? The second chart indicates that 0.22% of patients spent over $50,000 on Rx drugs in 2014, equal to about 576,000 people in the U.S. This group of patients represents 15.7% of total Rx costs, and 0.22% of patients.

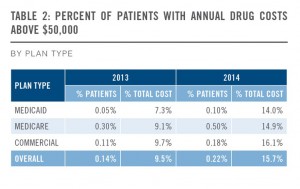

It’s instructive to look at the percent of patients with annual drug costs over $50K by health plan type, shown in the third chart. Note the doubling of the cost for patients enrolled in Medicaid between 2013 and 2014: this will be due in large part to the growth of new enrollees in health insurance plans, long missing the opportunity for health care access.

Of course, those said employers will pay attention to the line item of commercially-insured patients, whose drugs costs above $50K grew from just under 10% to over 16%.

There’s also good news for patients: on February 3rd, Gilead (which markets Sovaldi and Harvoni) said in its quarterly earnings call that it would reduce the price of the drugs on average 46% this year in the U.S. That’s because the company will face increased competition in the Hep C category — which will drive prices to treat the condition down, benefiting the entire value chain.

Express Scripts’ report mentions that high-cost drugs have historically covered small patient groups, but increasingly the FDA is approving specialty formulations that will treat conditions diagnosed in larger populations. For example, watch for heart disease to grow in this expensive-drug category in and beyond 2016.

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast