Covering the uninsured changes pocketbook problems, this chart demonstrates. The Kaiser Family Foundation (KFF) surveyed Californians between February and May 2015, and found that people newly enrolling in health insurance had less financial stress, and more health needs met.

Covering the uninsured changes pocketbook problems, this chart demonstrates. The Kaiser Family Foundation (KFF) surveyed Californians between February and May 2015, and found that people newly enrolling in health insurance had less financial stress, and more health needs met.

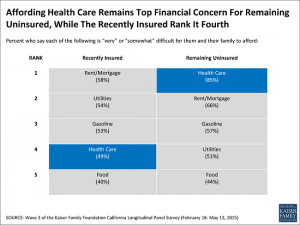

KFF asked previously uninsured Californians to rank five household “pocketbook” spending categories which they said were difficult to afford: health care, housing (rent/mortgage), gasoline, utilities, and food. Among the five, people gaining insurance worried much less about health care costs (49%, slipping to fourth place), and more about paying for shelter (58%), utility bills (54%), and gas (53%), shown in the first chart.

Those people remaining uninsured placed health care cost worries at the top of the list, cited #1 by 85% of the still-uninsured. Rent/mortgage fell to second place, followed by gas, utilities, and food.

While three-quarters of the newly insured people in the California poll said they’ve had positive experiences with their health plans, able to access doctors and hospitals, some people did have access problems: 16% of newly-insured people were told by a doctor’s office that they would not accept them as a new patient.

While three-quarters of the newly insured people in the California poll said they’ve had positive experiences with their health plans, able to access doctors and hospitals, some people did have access problems: 16% of newly-insured people were told by a doctor’s office that they would not accept them as a new patient.

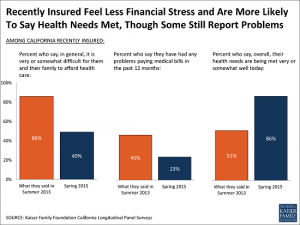

The bar chart shows he changes in the newly-insureds’ changing status when it comes to health cost affordability, problems paying medical bills, and health needs being met. On all three measures, newly insured people see improvement in their financial wellness and access to needed health care services.

Health Populi’s Hot Points: The Health Populi blog’s first post was titled Health Care Is The #1 Line Item in Our National Economy…and Taking More out of your Pocket, published on September 11, 2007, nearly eight years ago.

Back then, Tom’s Shell gas station was selling regular petrol for the price of an Arm, plus for a leg, and premium for your “First Born.” During the week of September 10, 2007, California gas prices were in real dollars $2.84, $2.95, and $3.06 respectively.

Freeing up household budget dollars from health spending enables consumers to re-work their pocketbook economics to pay for shelter, energy, and food. From the start of Health Populi, we’ve focused on the microeconomy of health care as integral to the overall macroeconomy — and how that impacts individuals and families.

The growth of consumer-directed health plans and people stretching new muscles to manage deductibles, out-of-pocket copayments and coinsurance, and health savings accounts only makes the theme of the household health economy more salient. Getting access to necessary health care services, coupled with good daily lifestyle decisions that focus on the right side of the social determinants of health (like nutritious food, early and ongoing education, safe streets, financial wellness, mental health), bolster the home healthcare economy, the community’s, the larger macroeconomy, and the public’s health.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a