In the growing value-based era of health care, patients are looking for real consumer experiences: being treated well, with respect, and with a high level of service people find in other industries.

In the growing value-based era of health care, patients are looking for real consumer experiences: being treated well, with respect, and with a high level of service people find in other industries.

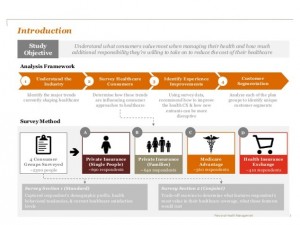

PwC polled about 2,300 U.S. adults online in June 2014, resulting in the paper, Personal health management: The rise of the empowered consumer, part of PwC’s research into The New Health Economy. In that New Health Economy, more consumers want to take control of their health, PwC discovered through the survey.

The three key parameters for this empowered health consumer are personal, proactive health management, service, and value, PwC says.

Proactive health management means people will go outside of the doctor’s office for health care advice and services, looking within the legacy healthcare system and increasingly to the growing array of outsiders providing accessible and convenient channels.

And for service, the second factor. New entrants are often more retail-styled: consider how Sephora brought the makeup out from behind the department store counter to allow customers to try out products in a DIY-testing mode. In healthcare, as people pay more out of pocket seeking transparency and support along the customer journey, new healthcare entrants, and switched-on health care providers, look to other industries for service mentoring.

That gets to value. There’s a cost-conscious consumer who’s splitting from other health consumers who will pay more for (perceived) high quality care. The value-shopping consumer is looking to pay for health care that’s “good enough.” Think: Costco, Walmart, Target shoppers.

PwC goes into great detail in the report about health plan member personae by consumer segment in each of four health insurance purchaser scenarios buying:

- Private health insurance, for individual/singles

- Private health insurance, for families

- Medicare Advantage plans

- via Health Insurance Exchanges.

For example, within private health insurance for single plan membrers, PwC identified Fitness-Focused Fay, Wary Walter, Trusting Terri, Preoccupied Paolo, and so on. Check out the report for descriptions on these and the other four consumer cohorts in the four heath plan segments.

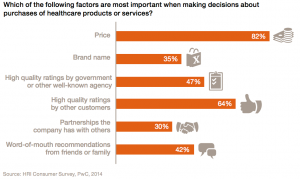

Health Populi’s Hot Points: While proximity, customer service, convenience, quality and aesthetics are highly-valued aspects of the new entrants in health care (pharmacies, retail clinics, urgent care, among other new services), price matters most as the second chart shows.

Health Populi’s Hot Points: While proximity, customer service, convenience, quality and aesthetics are highly-valued aspects of the new entrants in health care (pharmacies, retail clinics, urgent care, among other new services), price matters most as the second chart shows.

Note that price trumps quality for these surveyed consumers.

The nuance here is that, regardless of a “high end” health care purchaser or a value-shopper for health, all health care consumers seek respect and service levels they appreciate in other sectors where they are…consumers.

I point Health Populi readers to new consumer research from Mintel’s 2015 American Lifestyle Report whicih finds that consumers increasingly spend on experiences, not on accumulating “things.” While previous research has pointed to a trend among Millennials with this trait, Mintel finds that experiential buying is getting more common across different generations and socio-economic strata.

This has implications for healthcare as patients continue to morph into consumers. Connected, on-demand, accessible and customized experiences will be increasingly expected by more demanding health consumers.

One intriguing trend Mintel mentions is “Fight for Your Rights.” Technology is transforming citizens’ ability to crowdsource opinions across the continuum of passions and issues, and healthcare is primed for this. “Clicktivism” enables patient advocacy and patient-powered clinical trials, for example.

And consumers’ ratings of health care providers, plans, and products? We’ve only just scratched the surface. Kim Kardashian’s tweet which raised the hackles of the FDA is just a blip of what’s to come.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for