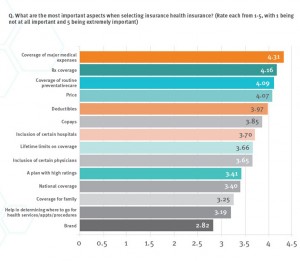

When Americans shop for health insurance (and they do – more, later in the post), they look most for covering major medical expenses, prescription drugs, preventive care, and price. Less important is the brand of the plan, or its high ratings.

Valence Health surveyed 524 U.S. consumers in June 2015 to learn how healthcare shoppers feel about health insurance and health reform. The results are published in the report, U.S. Attitudes Toward Health Insurance and Healthcare Reform in August 2015.

Key findings in the study were that:

- Price and coverage come before all other factors in evaluating health plans

- 73% of people are satisfied with their current health insurer

- 65% of people spent $500 or less on direct health care services their health plan didn’t cover

- One-third of people avoided recommended health care or prescriptions due to cost

- A plurality of health consumers (nearly 40%) spend at least 7 hours evaluating health insurance options for themselves or their families. About 3 in 4 people spend at least hours comparing health plan options

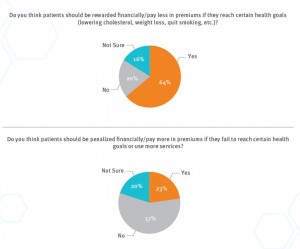

Valence Health gauged health consumers’ views on incentives and wellness. There’s a definite polarity when it comes to “carrots” versus “sticks:”

Valence Health gauged health consumers’ views on incentives and wellness. There’s a definite polarity when it comes to “carrots” versus “sticks:”

– Carrots: 64% of consumers think patients should be rewarded financially, or pay less, for health insurance premiums if they reach health goals like lowering cholesterol, losing weight, or quitting smoking.

– 23% of consumers think patients should be penalized financially or pay more for health insurance if they fail to meet certain health care goals or over-use health care services.

For the sticks, the poll found that 57% of people did NOT think patients should be dis-incentivized for NOT meeting health goals, or for be over-utilizers of health care.

Health Populi’s Hot Points: It seems that branding from a consumer-shopper’s point of view is less influential to the health insurance buyer than health-economic issues like coverage and price. As a result, consumers are open to new kinds of health plans, like provider-sponsored health plans (PSHP) that are made up of doctors, hospitals and other service providers taking on financial risks. This is the concept of an Accountable Care Organization (ACO).

In this survey, 21% of consumers said they’d likely switch to a PSHP from a traditional insurance plan. 35% said they’d be unlikely to switch, and 44% were unsure.

In this survey, 21% of consumers said they’d likely switch to a PSHP from a traditional insurance plan. 35% said they’d be unlikely to switch, and 44% were unsure.

Underneath that overall uncertainly about PSHPs is a lack of understanding of the concept of a PSHP and its potential benefits, such as continuity of care, population health management, and local ownership of the plan that could (could) bolster community accountability the way health consumers have viewed Blue Cross plans in the past (and where that local branding perspective persists currently, as well).

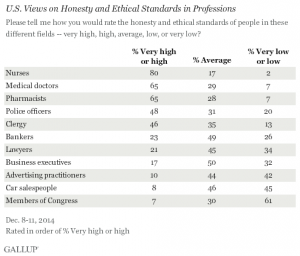

Because Americans have a high regard for doctors and much lower respect for health insurance companies, there is an opportunity for community-based ACOs to market health plan coverage based on trust, authenticity, and community. The chart shows the high trust equity enjoyed by providers (nurses, doctors, pharmacists).

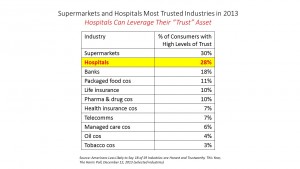

Health plans? Not so much. The Harris Poll found that supermarkets and hospitals are highly ranked for trusted industries. Health insurance is in the low-trust tier with telecomms, managed care, Big Oil, and Big Tobacco.

Health plans? Not so much. The Harris Poll found that supermarkets and hospitals are highly ranked for trusted industries. Health insurance is in the low-trust tier with telecomms, managed care, Big Oil, and Big Tobacco.

While “branding” per se may not be motivating as a purchasing hot button, trust is. The trust equity among health care providers — doctors and hospitals — can help bolster ACOs’ and PSHPs’ market expansion and a purchasing benefit valued by consumers seeking health insurance.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a