Fitbit, the company that makes and markets the most popular activity tracker, is getting serious about its users’ personal data. The company announced that it will enter into HIPAA business associate agreements with employers, health plans, and companies that offer workers the devices and the apps that organize and analyze consumers’ personal data.

Fitbit, the company that makes and markets the most popular activity tracker, is getting serious about its users’ personal data. The company announced that it will enter into HIPAA business associate agreements with employers, health plans, and companies that offer workers the devices and the apps that organize and analyze consumers’ personal data.

The Health Insurance Portability and Accountability Act (HIPAA) protects patients’ personal health information generated in a doctor’s office, a hospital, lab, and other healthcare entities covered under the law (as such, “covered entities”). However, data generated through activity tracking devices such as Fitbit’s many wearable technologies have not fallen under HIPAA’s healthcare privacy umbrella.

I wrote about these personal health data leaks in my paper, Here’s Looking At You, published by the California HealthCare Foundation in 2014.

Fitbit’s getting serious about privacy with this strategy, which will make it a more attractive health and wellness partner for companies to work with given that privacy and security of health data has been a prime deterrent preventing companies and consumers (here, employees) from engaging with wellness programs using activity tracking devices.

So just this week, Target announced that the company would contribute Fitbit Zip tracking devices freely to its 335,000 U.S. employees as part of their wellness program. Target will be working with Fitbit Wellness, the division of Fitbit that manages corporate relationships.

Target CEO James Park was quoted as saying that, “the cost of a Fitbit ($59.95 retail) device and the associated services is very small compared to the savings from a healthier employee population.”

Health Populi’s Hot Points: Pacific Coast Securities commented on the Fitbit-Target alliance, noting the deal will be pivotal for Fitbit to expand consumer markets in the Zeitgeist of the Apple Watch.

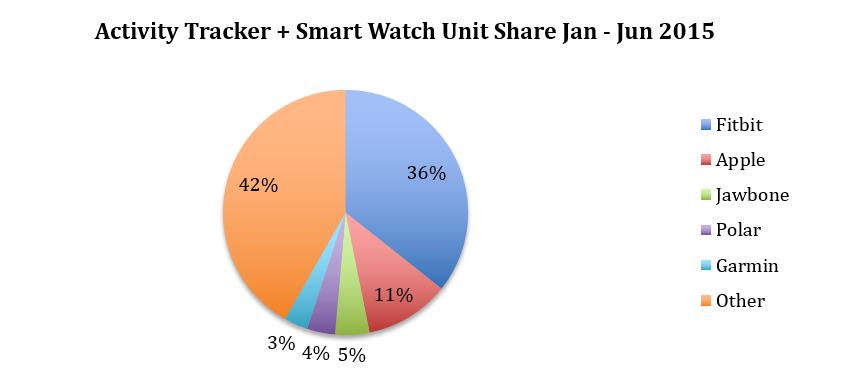

Interesting research on the face-off between Apple and Fitbit was done by industry analysts 1010data, who posed the question, Who’s Winning in Wearables?

There are two ways to look at the Apple-Fitbit competition when it comes to activity tracking. First is in terms of dollars generated by each device. In the case of the Activity Tracker + Smart Watch combined market, Apple garners 42% of revenues and Fitbit, 31% of revenues.

However, in terms of unit sales in this combined market, Fitbit gets 36% of the pie, and Apple, 11%.

For health”care” applications, on a pure cost basis per device, the retail price of $59.95 which Target CEO Park notes represents good value for his company’s wellness program is an attractive proposition compared with the price for a new Apple watch, a basic model of which would run $349 today in the Apple store for the Sport version.

But “value” is more than price, so the race is on. One important success factor in the health/care market will be how individual’s “small data” can be aggregated into Big Data to both enable individuals to benchmark themselves against other consumer-patients and benefit from individualized advice; and, for health providers and employers, to drive population health. Physicians and health care providers will be keen on Fitbit’s new HIPAA business associate agreements as the health industry has had to be a good data steward on behalf of patients. How will Apple be perceived through a privacy-brand equity lens? That response and risk will be in the eye of the beholder.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.