American workers are working to pay for health care costs, having traded off wage increases for health premiums, out-of-pocket costs and growing high deductibles. Welcome to the 2015 Employer Health Benefits survey conducted annually by the Kaiser Family Foundation (KFF) and Health Research & Educational Trust (HRET). Premiums are growing seven times faster than wages.

American workers are working to pay for health care costs, having traded off wage increases for health premiums, out-of-pocket costs and growing high deductibles. Welcome to the 2015 Employer Health Benefits survey conducted annually by the Kaiser Family Foundation (KFF) and Health Research & Educational Trust (HRET). Premiums are growing seven times faster than wages.

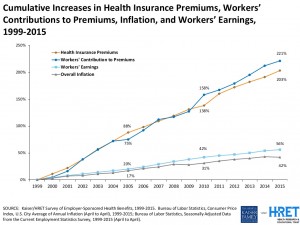

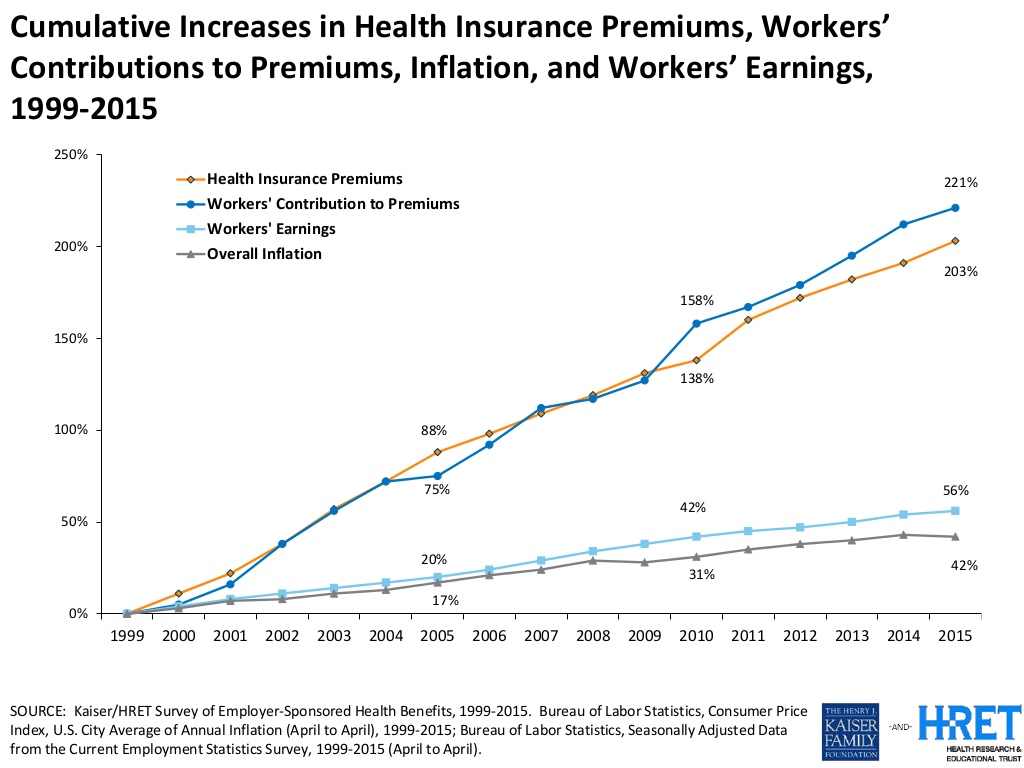

The report calculates that high-deductibles for health insurance have grown 67% from 2010 to 2015. In the same period, wages grew a paltry 10%, while the Consumer Price Index rose 9%. The first chart illustrates that growing gap between relatively flat wages and spirally health insurance premiums for people who receive health insurance at the workplace.

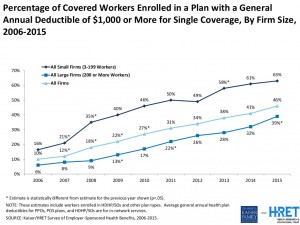

The second graph shows the growth of health plans with deductibles: in 2015, nearly one-half of covered workers are enrolled in a health plan with at least a $1,000 deductible for single coverage. Two-thirds of workers in small firms (3-199 workers) are covered in a plan with a $1,000+ deductible, versus 39% of workers in large firms with over 200 workers.

Average premiums for high-deductible health plans are lower than premiums for HMOs, PPOs, or POS plans. The average premium across all plans for a family is $17,545; for HDHPs, the premium on average is $15,970, with the worker covering $3,917 and the employer portion, $12,053.

KFF/HRET notes that workers in firms with a higher percentage of lower-wage workers have higher average contributions for family coverage ($6,382 vs. $4,829) than workers in firms with lower percentages of lower-wage workers.

Most employers continue to offer wellness programs screening via health risk appraisals and biometric screenings, with larger companies more likely to offer these programs than smaller firms. Just under one-third of large companies that offer health risk assessments, biometric screenings, and specific wellness programs couple the offering with an incentive to participate in that program.

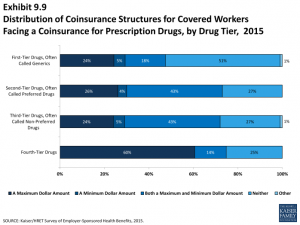

Virtually all covered workers in employer-sponsored plans have a prescription drug benefit. Nine in 10 have tiered cost-sharing for Rx, and more plans have four or more tiers of drug cost sharing (mostly used for specialty drugs – lifestyle drugs or high-cost biologics). HDHPs use different cost-sharing strategies for prescription drugs: 22% of workers enrolled in HDHPs are in a plan whose payment is the same regardless of drug type, vs. 8% of other plans.

Virtually all covered workers in employer-sponsored plans have a prescription drug benefit. Nine in 10 have tiered cost-sharing for Rx, and more plans have four or more tiers of drug cost sharing (mostly used for specialty drugs – lifestyle drugs or high-cost biologics). HDHPs use different cost-sharing strategies for prescription drugs: 22% of workers enrolled in HDHPs are in a plan whose payment is the same regardless of drug type, vs. 8% of other plans.

In the first three tiers of Rx plans (generic, brand on formulary, and brand off-formulary), copayments are more common than coinsurance. For workers in plans with three or more cost-sharing tiers, 50% face a copayment for fourth-tier drugs and 40% have coinsurance.

Specialty drugs such as biologics may be used to treat chronic conditions and often require special handling and administration. Many plans place specialty drugs on the fourth or higher tier of the formulary. Eighty-five percent of firms’ largest plan includes coverage for specialty drugs. Most covered workers with drug coverage are enrolled in a plan that covers specialty drugs such as biologics (94%). Specialty drugs are typically high cost; firms use a variety of strategies to contain these costs.

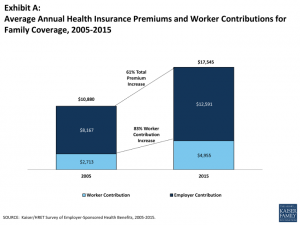

Health Populi’s Hot Points: With the headline that health insurance premiums for workers are growing seven times faster than workers’ wages, the fact remains that affordability in health care remains elusive notwithstanding the brand-name of health care reform (“The Affordable Care Act”). The final chart illustrates that painful growth of health costs for both employers (in the navy blue) and workers (in the light blue). Workers’ contribution to health insurance premium costs at the workplace grew 83% in the decade, and employers’ costs increased 61% as wages remained relatively flat.

Health Populi’s Hot Points: With the headline that health insurance premiums for workers are growing seven times faster than workers’ wages, the fact remains that affordability in health care remains elusive notwithstanding the brand-name of health care reform (“The Affordable Care Act”). The final chart illustrates that painful growth of health costs for both employers (in the navy blue) and workers (in the light blue). Workers’ contribution to health insurance premium costs at the workplace grew 83% in the decade, and employers’ costs increased 61% as wages remained relatively flat.

Today, Americans pay $1 in every $5 of annual household spending on health care costs, the Department of Commerce tells us. Health care crowds out spending on other family priorities: consider…

- Paying for college education, where the student loan debt has entered crisis proportions

- Moving to a new home, where sales for existing home stock are down in 2015

- Saving for retirement, with continued under-funding of 401(k) plans.

The continued financial risk-shift of health care financing onto working people compels the health-insured to become savvy health care shoppers as well as smarter patients. This calls for less binge-watching of TV and more binge-reading of health plans’ fine print, drug prices and alternative therapies, and taking advantage of growing retail-facing options for health care at the pharmacy, urgent care clinic, workplace health options, and telehealth choices.

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast